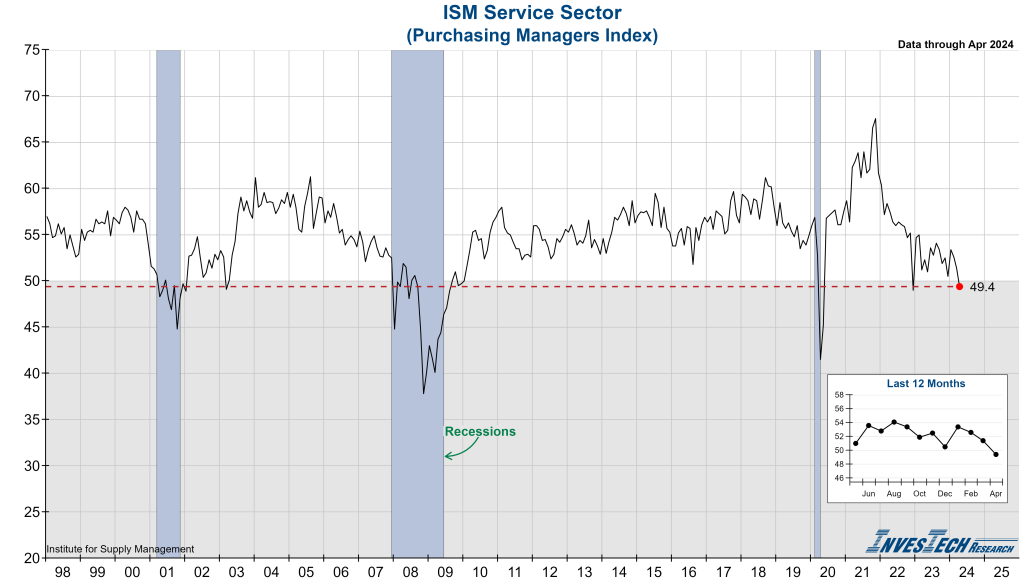

This morning, the Institute for Supply Management (ISM) released their Services Purchasing Managers Index (PMI) for the month of April. For the first time in 17 months, the Services PMI has fallen into contraction territory (<50.0), coming in at 49.4. Contraction in services is rare – aside from the brief contractionary reading in December 2022, the only other instances in the past two decades are the pandemic shutdown (2022) and the Great Financial Crisis (2007-2009).

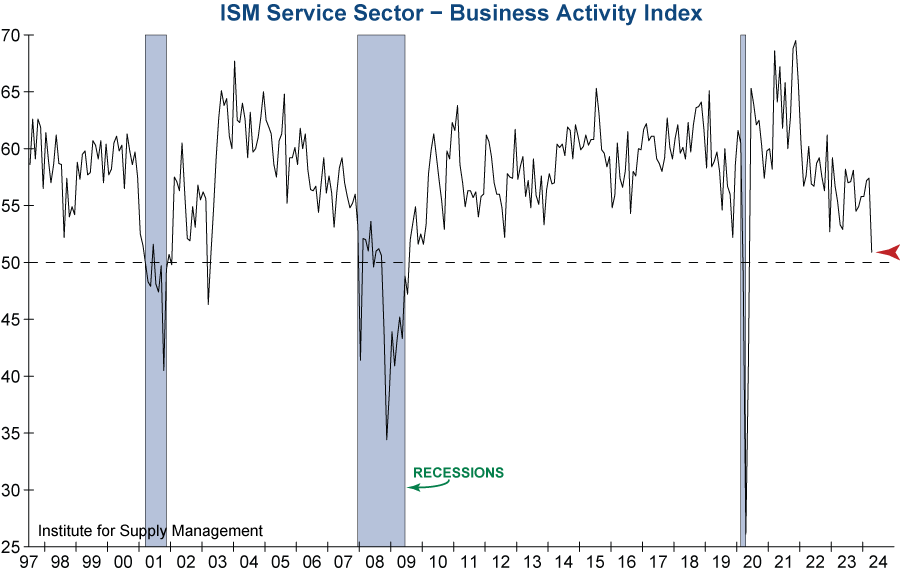

Additionally, a number of sub-indexes showed notable signs of weakness, including the Business Activity Index, which measures overall business activity and conditions in the services economy. While not in contraction, this Index is at its lowest level since 2009 (apart from the pandemic).

The New Orders and Employment sub-indexes were also down in April, with the Employment Index in contraction for the third consecutive month and moving lower at a faster rate. Additionally, the Prices Paid Index is up, which is moving in the opposite direction of the Fed’s preferred plan.

The rare warning flag raised by this indicator is noteworthy. If services continue this downward trend, it would spell trouble for the rest of the economy as service-based industries make up approximately 70% of U.S. GDP.