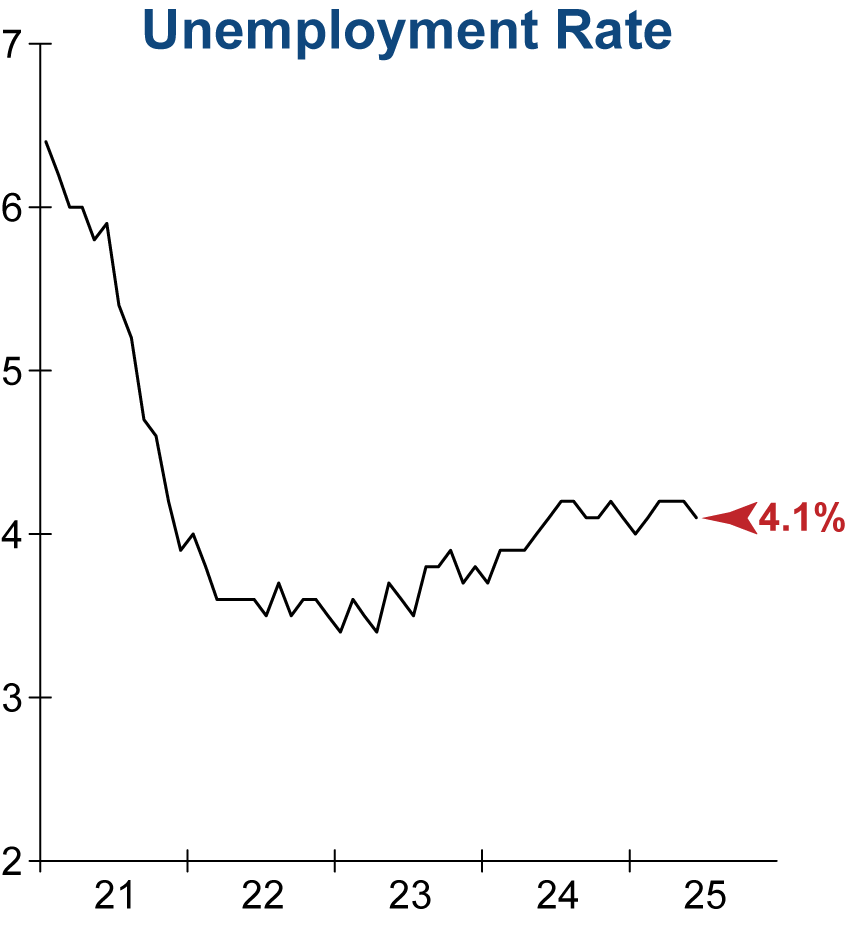

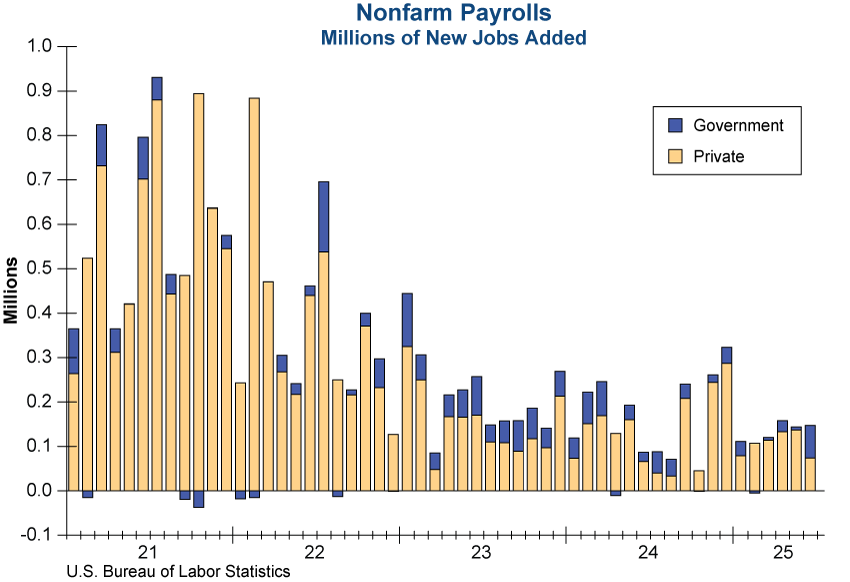

The June Employment Report showed a slight unexpected improvement in labor market conditions as the unemployment rate fell from 4.2% to 4.1% and 147 thousand jobs were added.

However, approximately half of the added jobs were in government, muting the positive development for the economy.

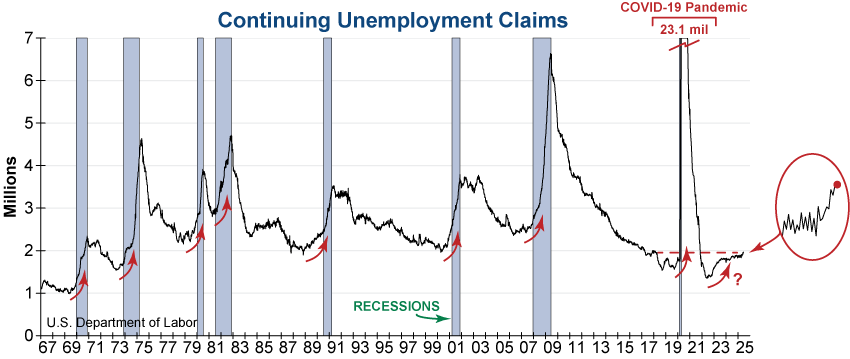

While the report was seemingly good news, it represents a conundrum with other employment data as shown in the June issue of InvesTech Research. An especially concerning labor market indicator is Continuing Unemployment Claims, which has continued its upward trend. This indicator usually rises going into recessions and should not be ignored.

Wall Street is greeting today’s positive employment report with incremental gains, but this development complicates the Fed’s path to rate cuts. The odds of a cut as implied by Fed Funds Futures at the July meeting fell from nearly 25% yesterday to less than 5% today. And the odds of a cut at the September meeting also declined from over 90% to 70%.

In summary, the day’s employment release was not as internally positive as reported in the media, or as greeted by Wall Street. In times of uncertainty like this, it is always safer to step softly and carry a comfortable cash reserve.