Investors cheered today’s employment report for September, with positive headlines touting the number of jobs added and the unemployment rate falling to 4.1%, despite ticking down just 0.1 percentage point…

U.S. Hiring Accelerated in September, Blowing Past Expectations – Wall Street Journal

September jobs report crushes expectations as US economy adds 254,000 jobs, unemployment rate falls to 4.1% – Yahoo! Finance

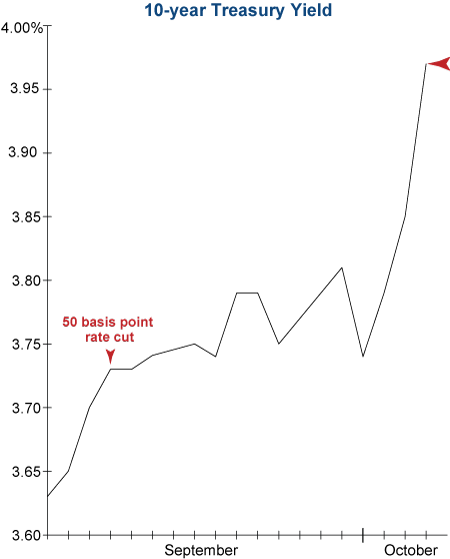

There is no doubt this jobs report is good news for those with soft landing hopes, but as shown by the move in the 10-year Treasury yield, strength in the labor market is beginning to throw cold water on potential interest rate relief for investors. In fact, long-term yields have actually increased notably since the Federal Reserve announced their much-anticipated rate cut just a little over two weeks ago.

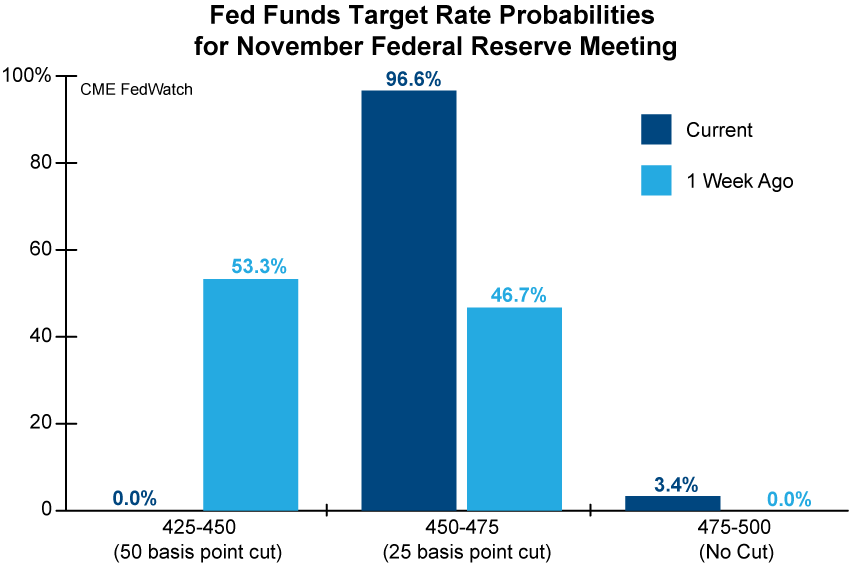

Fed Funds Futures are also being impacted. Just one week ago, the market was pricing in another half percentage point rate cut at the next FOMC meeting in early November. These expectations are quickly falling back to earth, with only a quarter point now being priced as a virtual certainty. Even a small possibility of a pause at the November meeting is a dramatic shift from one week ago.

The broadening market rally has been hanging its hat on the promise of substantial interest rate relief, and those hopes could be dashed. Although the jobs report was solid, other indicators continue to show a soft landing is far from assured. While we are believers in Marty Zweig’s famous phrase, “Don’t fight the Fed,” we also know an improbable soft landing is not a short-lived skirmish, but a long-term battle that is far from over…