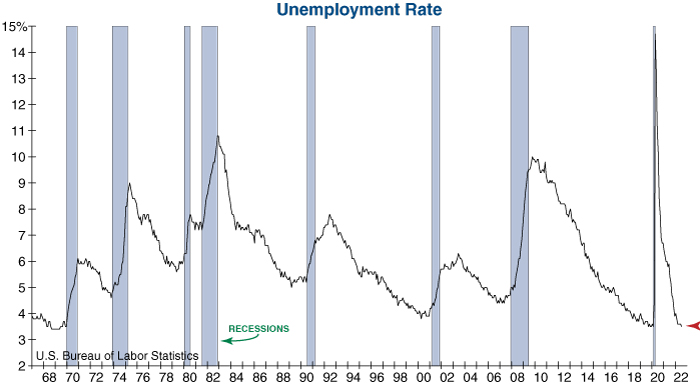

This morning’s employment report came in much stronger than expected. Employers added a whopping 528K jobs in July, and the unemployment rate ticked down to a new low of 3.5% (see graph below). While this was an undoubtedly strong report, there are growing signs that this strength may not last…

When we turn to the leading data, the employment picture becomes a lot less pretty. Job openings fell by -605K in June, the fourth consecutive decline and the largest drop on record outside of the pandemic lockdowns. Over the past 21 years, job openings have been a leading indicator of recession, dropping an average of -8% from its cyclical peak at the onset of recession. Today, job openings have fallen by -10% from its March peak.

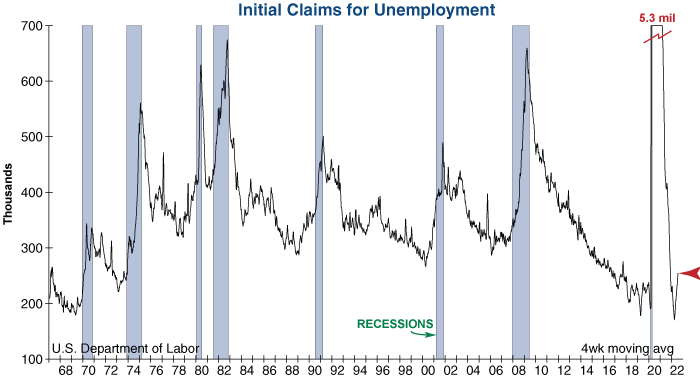

Initial claims for unemployment are also reiterating that the labor market has started to soften. Claims rose to 255K in yesterday’s release, compared to its record low of 171K reached in April. While this is still a relatively low level, it is concerning that initial claims have jumped by +84K from its low while the average increase at the start of recession historically has been +46K.

The more leading employment indicators shown above have reached levels often associated with the start of a recession, yet the Federal Reserve is most concerned with the unemployment rate which remains at a very favorable level. As a result, today’s positive employment report is one more factor that will keep the Fed tightening monetary policy in the months ahead.

Eli Petropoulos, CFA – Sr. Market Analyst