This week’s releases for the Consumer Price Index (CPI), the Underlying Inflation Gauge (UIG), and the Producer Price Index (PPI) showed signs of an improving inflationary environment as all three inflation gauges saw continued declines in March. However, while falling inflation seems like a positive development, a deeper analysis shows that drops of this magnitude tend to occur when economic conditions are potentially collapsing and there is little the Fed can do to “save the day.”

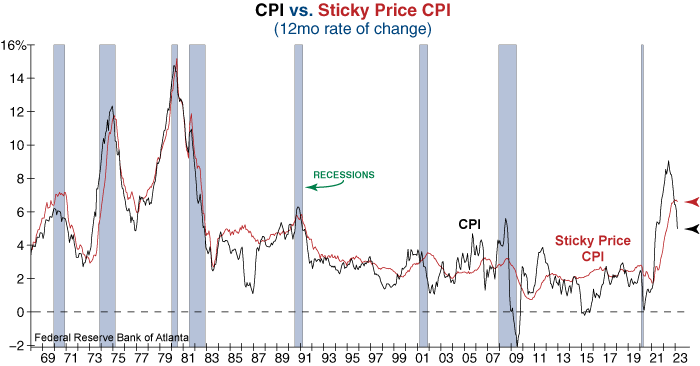

Headline CPI fell to 5% in March from 6% in February– a significant decrease. However, Sticky Price CPI – a weighted basket of items that change price relatively slowly – is at 6.5% YoY, down slightly from the previous month but falling much more slowly than Headline CPI. This tells us that today’s price pressures remain sticky in nature, significantly reducing the Fed’s ability to quickly shift policy should economic conditions continue to deteriorate.

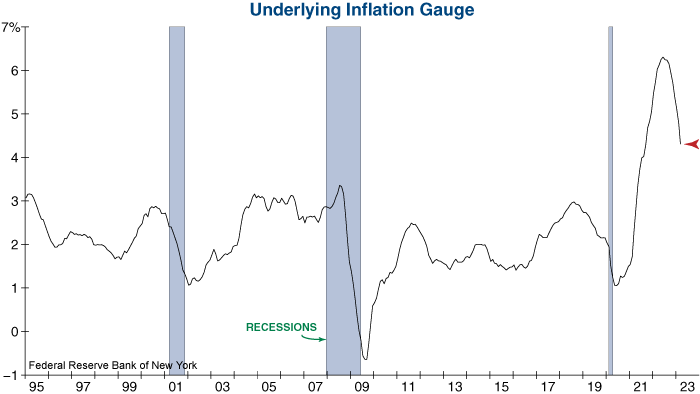

The UIG is a useful inflation forecasting tool that derives trend inflation from a wide range of nominal, real, and financial variables in addition to prices. The recent UIG release also showed a significant decrease last month. Looking at the graph below, this precipitous drop is telling as these tend to occur when economic conditions are deteriorating at a rapid pace.

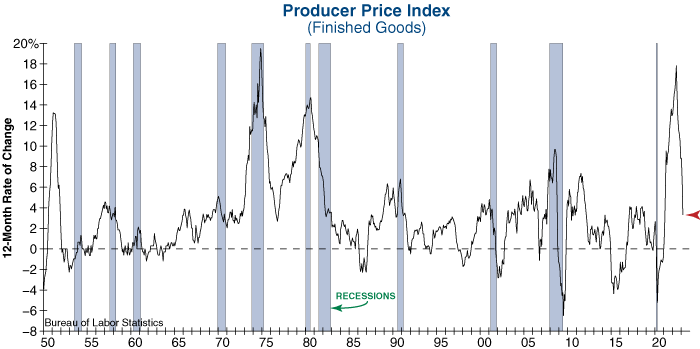

In addition to the March UIG, an important component of the recently released Producer Price Index (PPI) report called the PPI for Finished Goods is also experiencing a rapid decline. Again, drops of this magnitude tend to happen in or prior to recessions with only a few false signals…

While many are cheering these signs of softening inflationary pressures, the speed of the decline might be more ominous rather than hopeful.

Jill Mislinski – Research Director & Senior Writer