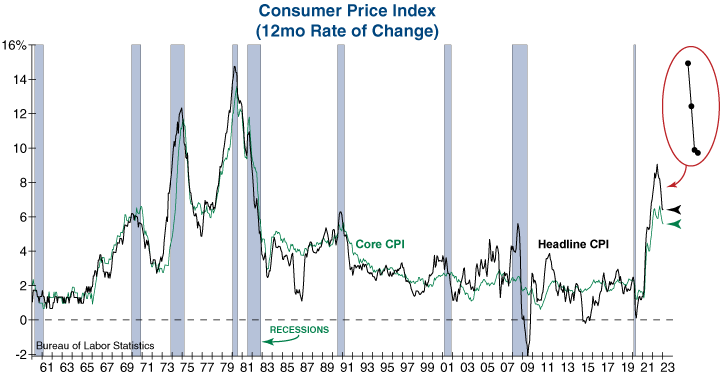

The Consumer Price Index (CPI) came in above economists’ expectations for January at 6.4% on a year-over-year seasonally adjusted basis even though it ticked slightly down from December’s reading of 6.5%. Core CPI –which excludes volatile food and energy prices– was also hotter than expected at a reading of 5.6%. With declines in inflation starting to slow, it’s clear the path to the Federal Reserve’s 2% target will not be easy…

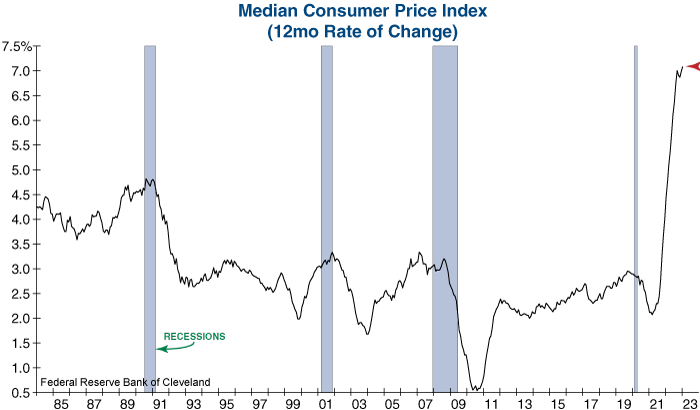

Another important measure of inflation is the Median Consumer Price Index as it is not skewed by large or volatile items. January’s report shows that inflationary pressures have become deeply ingrained as Median CPI rebounded sharply and now stands at the highest reading in its 39-year history! This clearly demonstrates the broad-based nature of today’s inflation and represents another challenge for Fed officials.

With inflationary pressures continuing to persist, the Federal Reserve is expected to maintain a path of tightening monetary policy in the months ahead:

January Inflation Keeps Federal Reserve on Track for More Interest-Rate Increases

Wall Street Journal, 2/14/23

As a result, monetary policy and interest rates remain a key source of risk which could threaten to upend 2023’s strong start in the stock market – especially if the technical evidence begins to falter…

Eli Petropoulos, CFA – Sr. Market Analyst