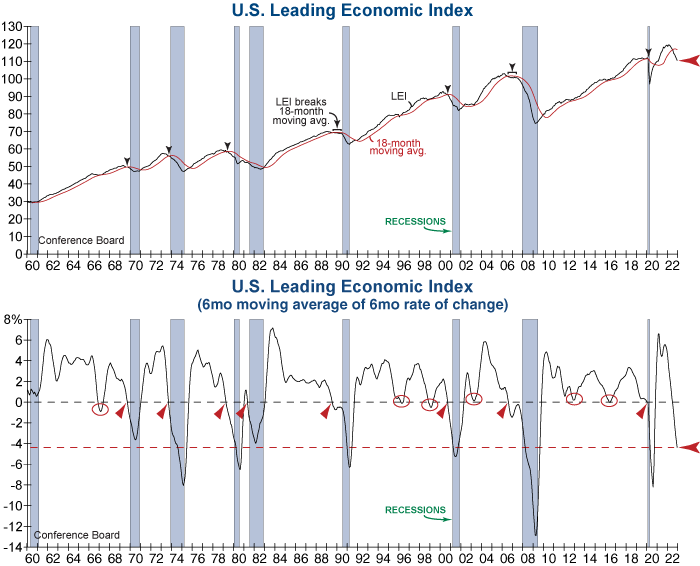

The Conference Board’s Leading Economic Index (LEI) fell for the 10th consecutive month in December, as negative contributions from eight of its ten components shows broad-based weakness. With the LEI now far below its 18-month moving average (top graph) and its six-month moving average of the six-month rate of change deeply negative (bottom graph), history indicates that recession is most likely already underway. The Conference Board concurs, stating that the LEI is “continuing to signal recession for the US economy in the near term.” In spite of another negative LEI data point, the market continues to remain stable – confirming the current tug of war between macroeconomic weakness and technical strength in breadth and leadership.

Eli Petropoulos, CFA – Sr. Market Analyst