The Conference Board’s Leading Economic Index (LEI) fell for the 12th straight month in March as eight of its ten components were either flat or negative. Last month’s -1.2% drop in the LEI was far worse than economists expected and is the worst drop since the pandemic-induced recession in early 2020.

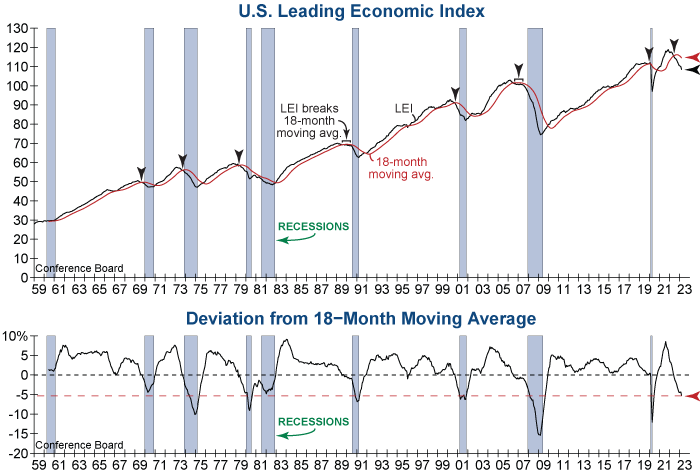

With the LEI continuing to solidify its warning flag, there is a growing probability that a U.S. recession will be unavoidable. The LEI is now more than 5% below its 18-month moving average, which has historically only ever occurred during a recession (see graphs below). So, while its lead times to recession can vary, the LEI’s reliable 60-year track record means this is a warning signal which simply cannot be ignored by risk conscious investors…

Eli Petropoulos, CFA – Sr. Market Analyst