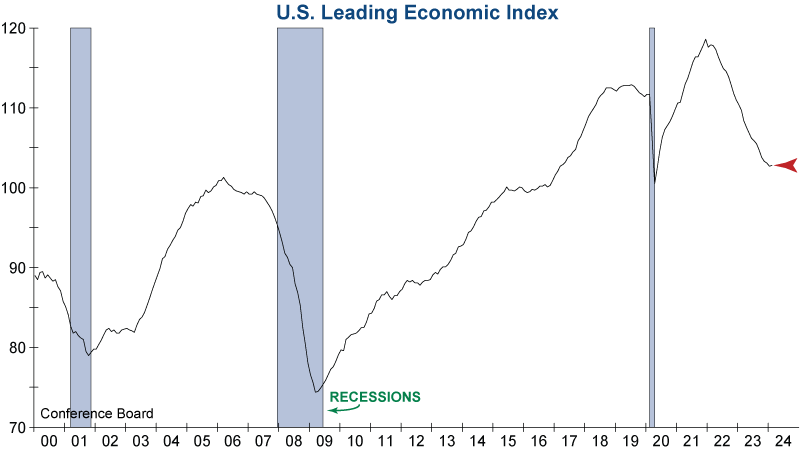

The Conference Board’s (CB) Leading Economic Index (LEI) increased 0.1% in February – its first monthly increase since February 2022. Major contributors to the increase include strength in stock prices, the CB’s Leading Credit Index, weekly hours worked in manufacturing, and residential construction. Still weighing on the Index are consumers’ expectations for business conditions, new orders, as well as the inverted yield curve.

Additionally, the CB’s Coincident Economic Index rose in February by 0.2% after ticking up in January. All four components of the index – payroll employment, personal income less transfer payments, manufacturing & trade sales, and industrial production – were positive last month. As a result, the LEI-to-CEI ratio declined again for February, though at a slower rate. This matches the longest decline in its history – during the Great Financial Crisis – at 24 months.

According to the Conference Board, “Despite February’s increase, the Index [LEI] still suggests some headwinds to growth going forward,” and they expect annualized GDP to slow over the next couple of quarters. Headwinds indeed remain, but it is prudent to give this improvement in the leading economic evidence the benefit of doubt. If other macroeconomic data, like ISM Manufacturing and Services and consumer optimism all shift course, it will increase the possibility of an elusive soft landing scenario.

See our latest update to the Model Fund Portfolio.