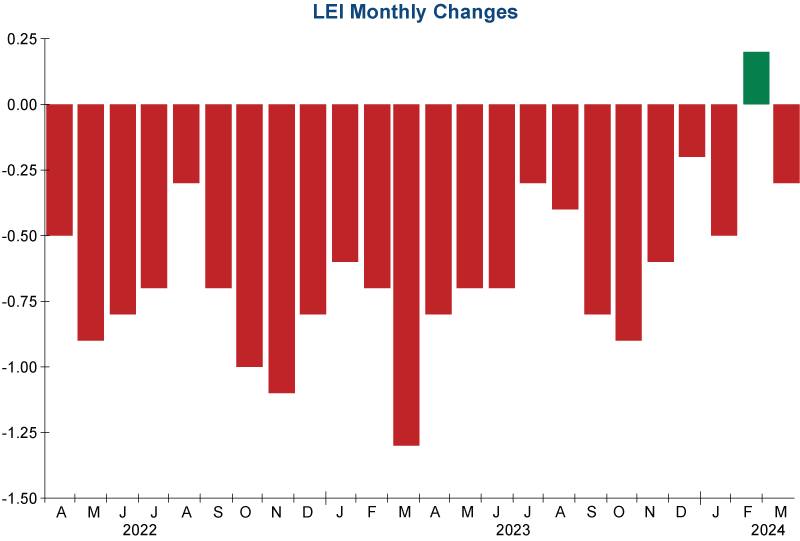

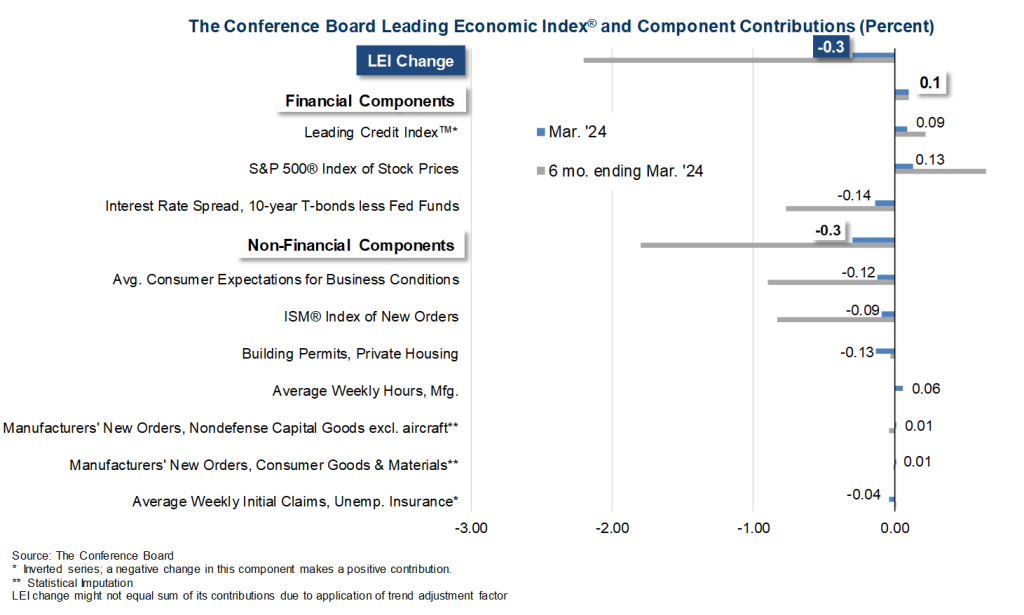

The Leading Economic Indicator (LEI) from the Conference Board has fallen 0.3% in March after a brief, one-month improvement in February. It has declined 24 out of the last 25 months and continues to provide a recessionary outlook. Half of the ten components that make up the LEI were negative. The majority of the decline was driven by adverse monetary conditions (negative yield spread) along with weakness in building permits, consumer sentiment, and new orders.

Per the Conference Board, the six-month growth rate is out of the danger zone. However, February’s one month of improvement does not equal safety, made clear by comments from the latest press release:

“February’s uptick in the U.S. LEI proved to be ephemeral as the Index posted a decline in March,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “Negative contributions from the yield spread, new building permits, consumers’ outlook on business conditions, new orders, and initial unemployment insurance claims drove March’s decline. The LEI’s six-month and annual growth rates remain negative, but the pace of contraction has slowed. Overall, the Index points to a fragile—even if not recessionary—outlook for the U.S. economy…”