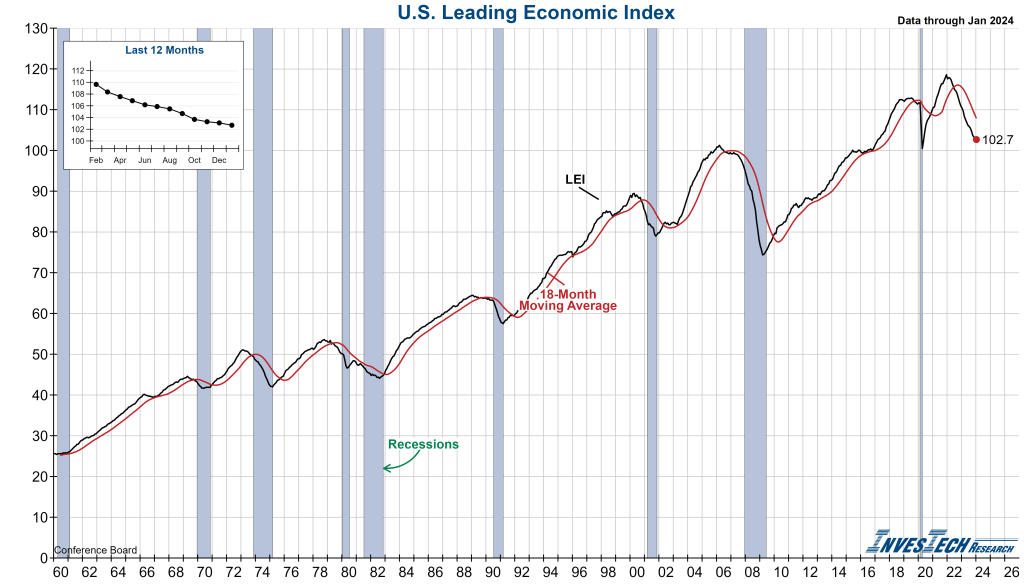

This morning’s release of the Conference Board’s Leading Economic Index (LEI) for January disappointed expectations and fell for the 23rd consecutive month, its second longest stretch in the series’ history. In January, only three of its ten components contributed positively: stock prices, the Leading Credit Index, and manufacturers’ new orders for consumer goods and materials. However, because the Index has been in such a protracted decline this continued contraction is slowing when compared to six months ago, with six of ten components contributing positively over the last six months. Because of this, the Conference Board is no longer forecasting a recession ahead, but rather a severe slowdown in GDP in 2024:

“While the declining LEI continues to signal headwinds to economic activity, for the first time in the past two years, six out of its ten components were positive contributors over the past six-month period (ending in January 2024). As a result, the leading index currently does not signal recession ahead. While no longer forecasting a recession in 2024, we do expect real GDP growth to slow to near zero percent over Q2 and Q3.”

While not the measured improvement we were looking for, this slowing 6-month downtrend could signal that a reversal may be in the cards in the coming months. We will continue to watch the LEI along with the weight of the evidence for a possible soft landing scenario.