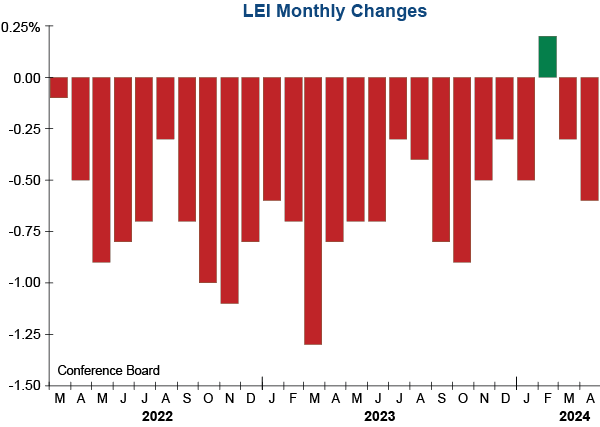

The April reading suggests that softer economic conditions lie ahead. Components that contributed negatively to the Index in April include the negative yield spread (inverted yield curve), consumer’s outlook on business conditions, weaker new orders, a fall in building permits, and for the first time since October of last year – stock prices.

Here’s an excerpt from the latest press release:

“Another decline in the U.S. LEI confirms that softer economic conditions lay ahead,” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board…. elevated inflation, high interest rates, rising household debt, and depleted pandemic savings are all expected to continue weighing on the US economy in 2024. As a result, we project that real GDP growth will slow to under 1 percent over the Q2 to Q3 2024 period.”