The Leading Economic Index (LEI) from the Conference Board fell again by 0.6% in July, which was much worse than expected. Weakness was shown to be widespread in non-financial components. The decline was led by a sharp drop in new orders, weak consumer expectations of business conditions, softer building permits, and fewer hours worked in manufacturing. The monthly changes in LEI (graph below) show how prolonged periods of significant negative readings are always accompanied by a recession.

Here’s a quote from the latest press release:

“The LEI’s annual growth rate has stabilized but remains negative, suggesting downward pressures on economic activity ahead.”

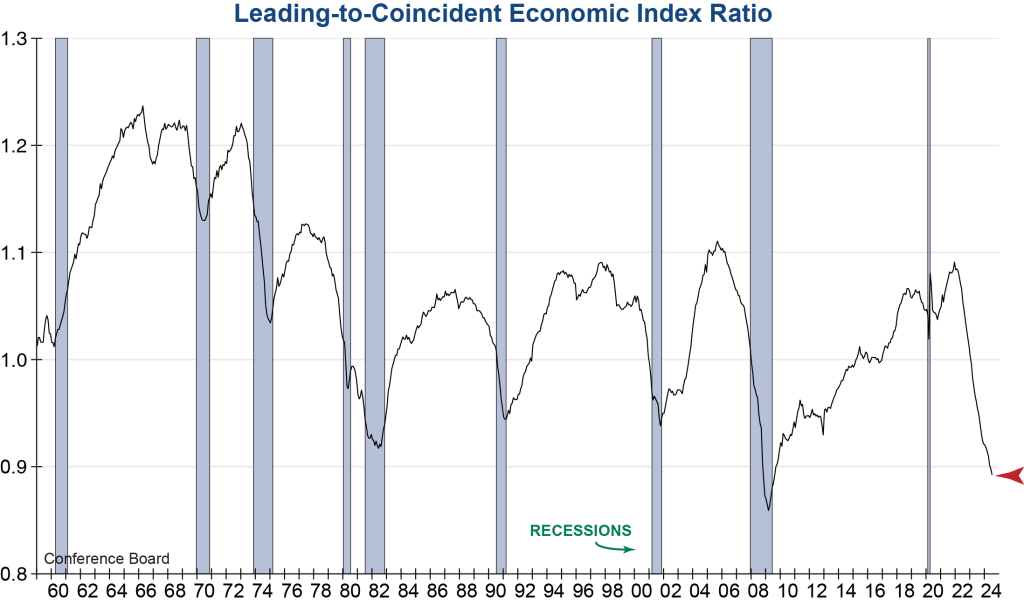

The Coincident Economic Index (CEI) inched down in July, making the LEI/CEI ratio (graph below) negative for a record 29 consecutive months. While lead times for this leading-to-coincident ratio have varied, it is useful in identifying economic inflection points, and declines of this magnitude have, once again, always ended in recession.

While the Conference Board is not calling for a recession immediately ahead, they expect slow growth over next few quarters as consumers and businesses continue to cut back. It seems it’s only a matter of time before current conditions begin reflecting the weakness shown in leading indicators and downward pressures have a sizeable impact on the economy.