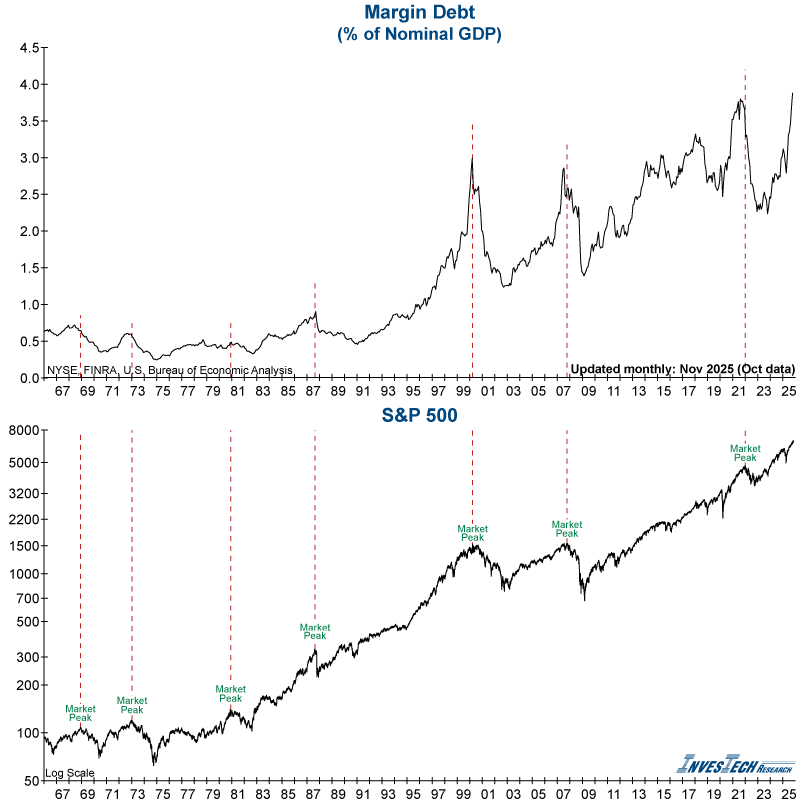

Margin debt, which represents the amount of money borrowed by investors to buy stocks on margin, jumped +5% in its latest release. This pushed margin debt as a percentage of nominal GDP —which we look at to put the figure in historical perspective— to a new all-time high.

Lofty levels of margin debt represent significant levels of risk. Margin debt is known as “hot money” as the funds will head for the exit quickly at the earliest sign of trouble or when margin calls hit and leveraged positions must be sold. In a downturn they could gather speed and momentum – likely causing the downward path to accelerate.

The Margin Debt Carry Load, which looks at margin debt multiplied by an estimated margin rate, also hit a new all-time high. This indicator gives us even more in-depth historical context, as large multi-year increases in margin debt, especially in the face of high borrowing costs, often precede major market tops.

In addition to warning of substantial leverage in today’s market, this datapoint tells us that investor speculation is at an extreme. As investor exuberance moves even further out of touch from fundamentals, now is not the time to get complacent.