Market cycles will always be a part of the investment picture. That’s why managing portfolio risk is critical in order to preserve and continue to build on hard-earned gains. This special report details the key components of our “safety-first” strategy that are essential in helping to survive bear markets and enhance long-term profits.

The Secret to Long-Term Profits

On Wall Street, the focus is always on profits, profits, and more profits… in other words, how to get the maximum return on an investment. While bear markets are obviously a nuisance, investors are told that you just have to hold on long enough and these setbacks become a non-issue – risk will take care of itself. However, that’s not always the case!

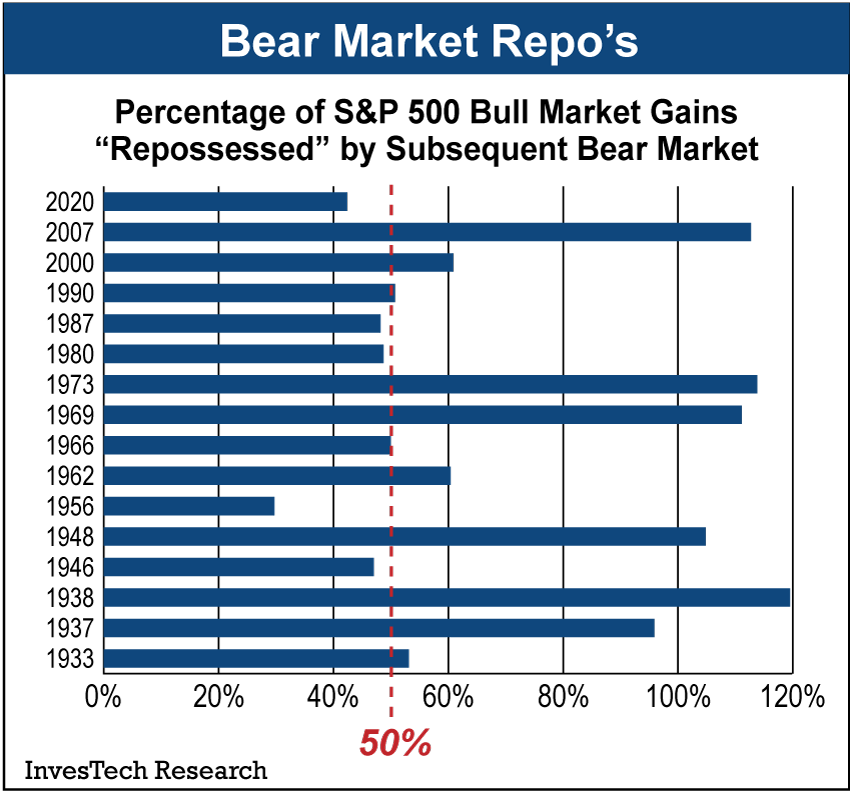

Actually, major downturns in the market can present dramatic setbacks to achieving long-term financial goals. As shown in the chart at left, bear markets typically reclaim about half of the gain from the previous bull market, and a major bear like 2007-09 can wipe out all of the bull market gain and more.

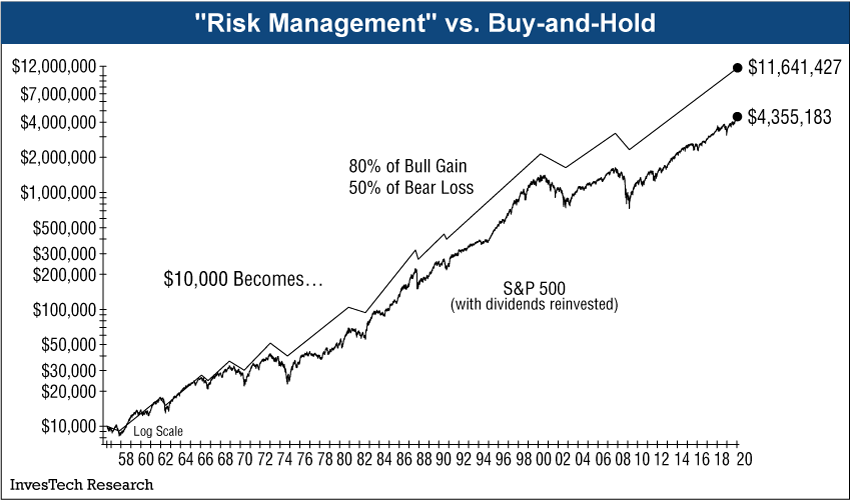

The historical fact is that bear markets can be devastating, and managing risk in one’s portfolio is at least as important as seeking profits, if not more so. And a critical part of risk management is minimizing the damage from major bear markets. As shown in the graph at right, if you cut bear market losses in half and capture just 80% of the upside in bull markets, you can significantly outperform a buy-and-hold strategy over the long-term.

Containing downside risk has additional advantages. Limiting bear market losses means your portfolio doesn’t have to gain as much to recover, which reduces the temptation to take excessive risk in the next bull market. Also, a strategy that manages risk is inherently less volatile and you shouldn’t ever have to suffer the anguish of seeing your investments cut in half. By avoiding this pain, investors are more likely to be comfortable going back into the market early for the next bull market run when risk is lowest and the profit potential is highest.

With our “safety-first” strategy, managing risk helps avoid most of the damage from major bear markets while still capturing a significant portion of the upside in bull markets. Our goal at InvesTech Research is to limit such losses to less than half the market decline. In the 2007 recessionary bear market, the S&P 500 declined 55% compared to a 26% drop in the InvesTech Model Portfolio. Consequently, the S&P 500 needed a 122% gain off the bottom to recover fully, while InvesTech required a 35% rebound to reach new highs. So what steps can you take to manage risk in your own portfolio?

Constructing a safety-first portfolio is comprised of three basic components and requires careful attention to each of the following:

- Allocation to the market.

- Sector balancing.

- Bottom-up, fundamental research in selecting exchange-traded funds (ETFs) or stocks.

Although this 3-step process appears simple, it requires time, commitment, and discipline to implement effectively.

Investment Allocation

The most effective tool in our arsenal of defensive measures is allocating assets to the market based on risk. This is fundamentally different from a buy-and-hold philosophy which stays fully invested at all times. With a safety-first strategy, cash is viewed as an investment alternative which is used –at times along with a defensive hedge or bear fund– to reduce exposure when market risk is elevated.

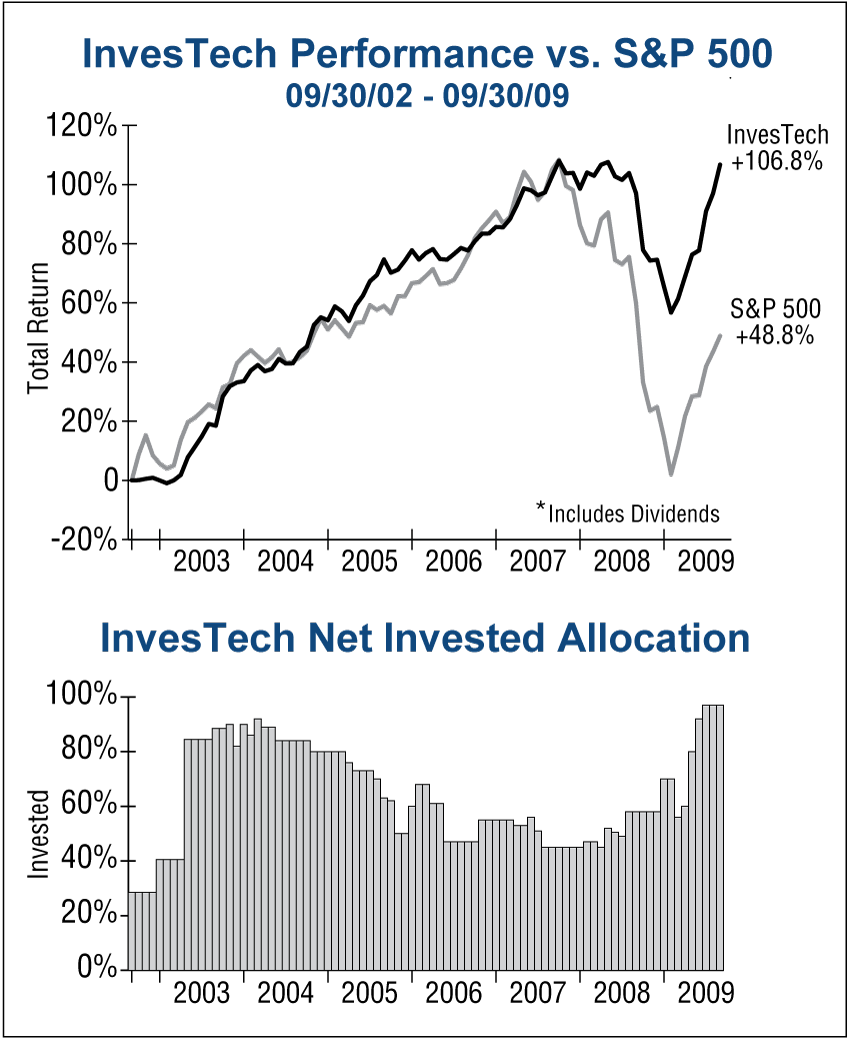

Allocation to the stock market must remain flexible. The graph below shows how our invested allocation changed significantly over a market cycle:

Generally speaking, we step up quickly and are more aggressively invested in the early or lower-risk stages of a bull market, as evident in both 2003 and 2009. In fact, we usually start adding ahead of the bear market bottom.

An examination of past market cycles shows that in the majority of cases nearly half of the potential profits are realized in the first one-third of a bull market. As the bull market ages and risks increase, we generally start taking some profits and moving to a lower invested allocation.

Sector Balancing

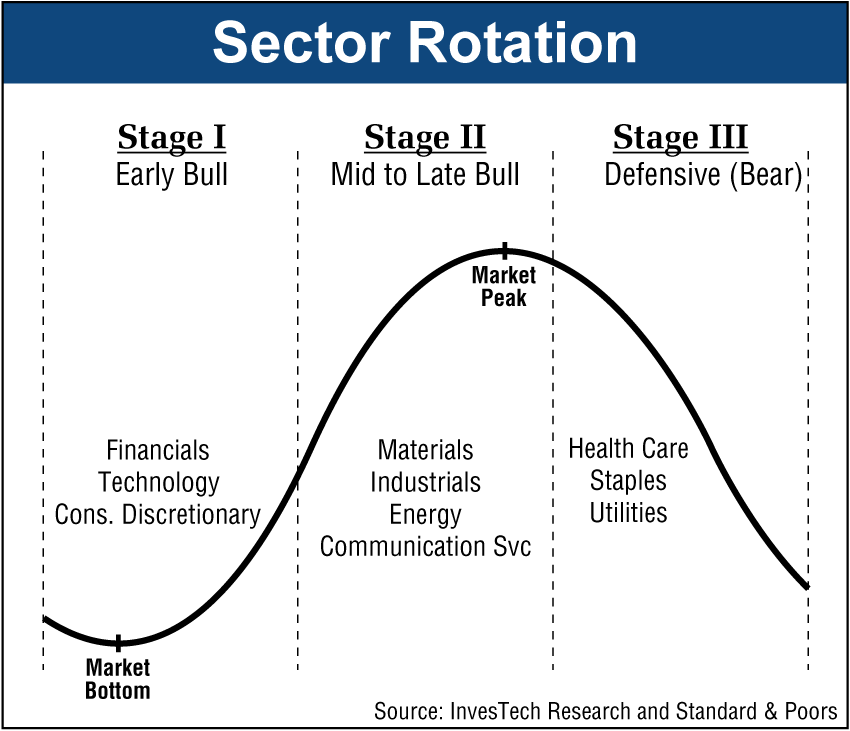

Once overall allocation is determined, sector adjustments are used to enhance returns in bull markets and reduce risks in bear markets. History shows that sector leadership can change significantly under various market and economic conditions. We developed the following diagram to show the three stages of a market cycle, along with the sectors that have historically outperformed during each stage:

• Stage I encompasses the transition from late bear market to early bull market. This is when cyclical sectors such as Financials, Technology, and Consumer Discretionary tend to outperform. Remember that the stock market generally leads an economic recovery, and as consumers and businesses start to feel better, they begin spending again in the discretionary areas where they may have delayed purchases.

• Stage II is the mid to late bull market period when economic growth is more firmly established. Materials and Industrials tend to outperform during this stage and are usually joined by Energy and Communication Services stocks as the bull market matures.

• In Stage III, as the bull market runs out of steam and a bear market takes hold, the non-discretionary sectors –Health Care, Consumer Staples, and Utilities– are usually the most resilient. These companies provide products and services that people need regardless of how bad they feel about the economy or the stock market.

Historical studies like this can be used to position the portfolio based on where we are in the market cycle. In other words, sector allocations should be adjusted to focus on changing market conditions. Used effectively, sector weightings can enhance returns and help reduce risk. For instance, looking at the InvesTech Net Invested Allocation graph shown earlier, our Model Fund Portfolio was 45-55% invested throughout 2007, yet the portfolio managed to double the 5.5% return in the S&P 500 that year.

Exchange-Traded Fund or Equity Selection

The final component of developing a safety-first portfolio is using detailed, bottom-up fundamental analysis in choosing investments. The easiest way to implement our allocation and sector strategies is with sector ETFs, which are currently used in the InvesTech Model Fund Portfolio. For those who have the time and interest, seeking attractive stocks within a sector can enhance performance, but requires careful research and tracking.

In using a straight forward sector ETF strategy, there are some key points to remember when selecting the funds. There are over 3,300 equity ETFs available on the major exchanges, and not all are created equal. As with any investment, you need to conduct due diligence and understand what you are buying. In choosing ETFs, we recommend you follow these basic criteria:

ETF Selection Criteria

● > $200 million in assets.

● Adequate trading liquidity.

● ETF holds all/most of the securities in the index.

● Minimum 5-year track record.

● Experienced ETF sponsor/manager.

- The ETF should have at least $200 million in assets and adequate trading liquidity. Larger funds are more widely held and frequently traded, which helps keep the fund price in line with the net asset value (NAV) of the underlying portfolio. Also, you want to be sure that you can buy or sell the fund when you want – smaller or more specialized funds may not trade every day.

- Composition of the fund’s portfolio is important and we feel that an ETF should hold all or most of the securities in the index that it’s designed to follow. Most index ETFs structure their portfolios based either on replication or sampling. With replication, the fund holds all the stocks in the index at approximately the same weighting as the index. If sampling is used, the fund sponsor selects a representative sample of the stocks in the index with the intent of duplicating the index performance. We prefer the replication method for more accurate tracking. With sampling, there may be a greater potential for performance discrepancies, depending on the sample size.

- The fund should have at least a 5-year track record and demonstrate good correlation with the underlying index. The ability to review a 5-year track record allows you to confirm that the ETF performance correlates with the index it is designed to track. Although ETF prices can be affected by supply/demand in the market, all ETFs have a system of share creation and market arbitrage that helps keep the ETF’s price correlated with the value of its underlying portfolio. This process is very efficient with large, frequently traded ETFs, but smaller illiquid funds can be prone to tracking error, making it important to be able to check the fund’s tracking history.

- Choose funds that are sponsored by industry leaders. With index ETFs, the sponsor selects the index that will be followed and the method used to track it. We prefer funds that are designed and managed by experienced fund companies that are well acquainted with the ETF market. Although there are multiple ETF providers, the vast majority of assets are concentrated in ETFs issued by BlackRock, State Street, and Vanguard.

Also, although there’s been a proliferation of specialized funds in the past few years, we would avoid most of the commodity, currency, leveraged, or esoteric funds that have been launched more recently. These tend to be volatile and can be prone to problems both in liquidity and pricing. We consider most of them to be speculative and, unless you understand the intricacies of these specialized ETFs, it’s best to stay away.

Selecting individual equities to contribute to the sector allocation is more challenging and requires both time and commitment in performing initial due diligence, as well as a process for monitoring your investment to ensure it continues to meet your criteria. When selecting stocks, the focus should be on four key areas:

- Superior profitability and growth: Look for steady revenue growth, profit margins that are better than peers, and superior profitability or Return on Equity (ROE) of at least 15%.

- Competitive advantage: Focus on market leaders that enjoy high barriers to competition. A unique competitive advantage –such as a controlling market share, patent protection, or efficiencies in production and distribution– helps make attractive growth and profitability sustainable.

- Financial strength and discipline: A low debt level, stable cash flow, and clarity of financial statements are important, particularly in a higher risk market environment. Also look for responsible use of company funds for acquisitions, expansions or stock buybacks.

- Attractive valuation: For a profitable investment, it’s important to not pay too much for a good company. Seek out firms that are selling at a discount to fair value based on relevant valuation metrics including price-to-cash flow, price-to-sales, and price-to-earnings.

Investments that meet the above criteria can add an extra margin of safety to the portfolio. They not only tend to survive in bear markets, but they prosper when conditions improve.

Summary

In the coming years, we believe adhering to a safety-first philosophy will be more important than ever and managing risk in your portfolio should be a top priority. Remember, it’s not how much you make in a bull market that counts, but what you have left after the bear market does its damage. Following a safety-first strategy as described here can be the key to protecting your portfolio and enhancing your future profits.

This report is also available to read in PDF format.