This morning’s report on New Residential Sales from the U.S. Census Bureau seemed positive on the surface. However, it reveals ominous underlying weakness in the housing market.

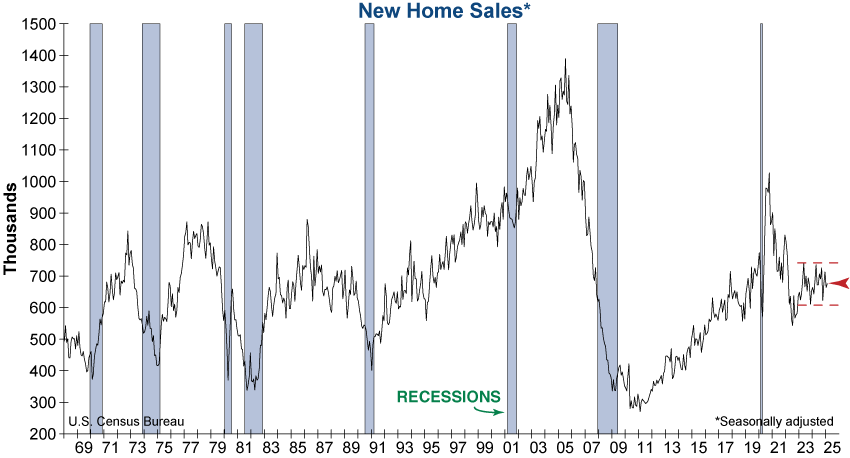

New Home Sales rose more than expected, up 1.8% from last month, however, the annual rate of sales remains relatively in line with the range over the past few years (graph below).

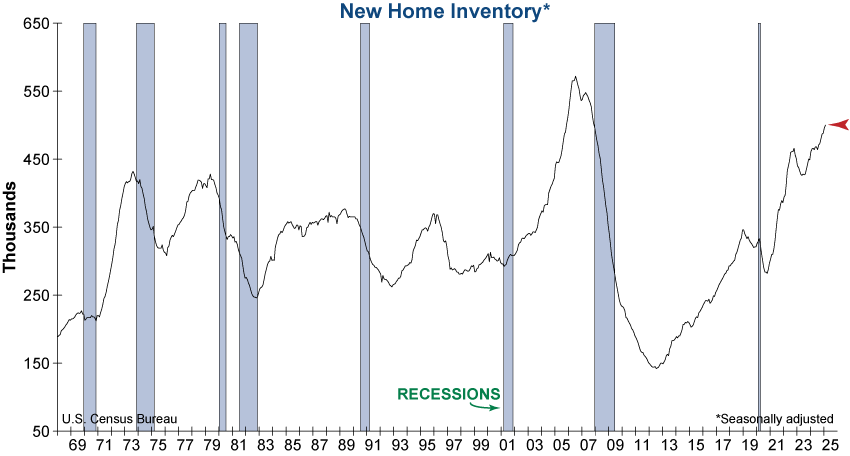

The inventory of unsold new homes also rose, up to 500,000 homes. This is the highest level on record outside of the last housing bubble. Worse yet, most new homes for sale are still under construction, while only a quarter of the total unsold new homes are completed. This is a concerning sign for homebuilders that the glut of inventory will likely continue to grow.

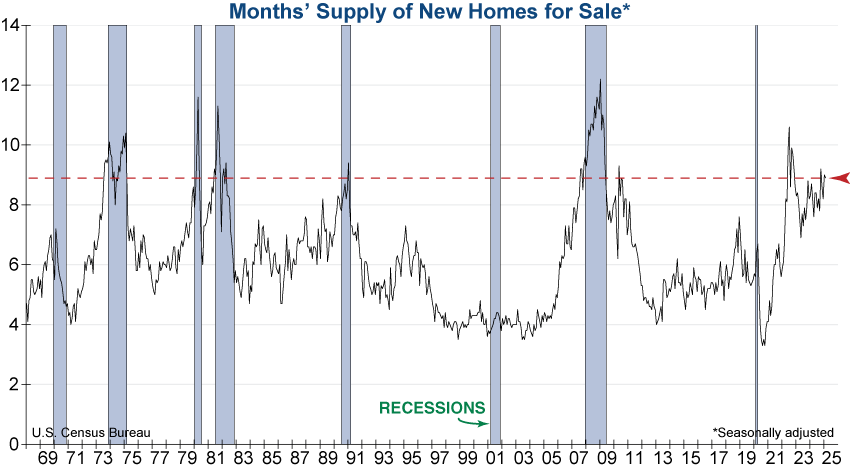

Ultimately, sales are not keeping pace with the rate at which new homes are coming onto the market. In fact, today’s level of inventory represents 8.9 months of supply at the current sales rate. According to the National Association of Realtors (NAR), a balanced market has 5 to 7 months of supply, making the current level well into the range of excess supply. A continued disconnect between sales and inventory growth could lead to serious problems for homebuilders, and the broader housing market.

This report was not alone in exposing troubles in housing. InvesTech’s Housing [Bubble] Bellwether Barometer still sits squarely in warning territory, and it will be essential to watch along with other leading housing indicators as a breakdown in this critical sector would have wide-reaching effects on investor psychology and financial markets.