The Pending Home Sales Index plummeted in its latest release, falling -6.3% to its third lowest reading on record.

In this worse-than-expected release, NAR Chief Economist Lawrence Yun said,

At this critical stage of the housing market, it is all about mortgage rates. Despite an increase in housing inventory, we are not seeing higher home sales. Lower mortgage rates are essential to bring home buyers back into the housing market.

Although historically low, existing home inventory is up +20% since last year. Mortgage rates, however, have held firmly above 6% for nearly 3 years and are currently near 7.0% – far higher than the post-COVID rock bottom rates and the average of 5% over the last 25 years. These elevated rates in conjunction with record high home prices have a significant negative impact on affordability, slowing home sales.

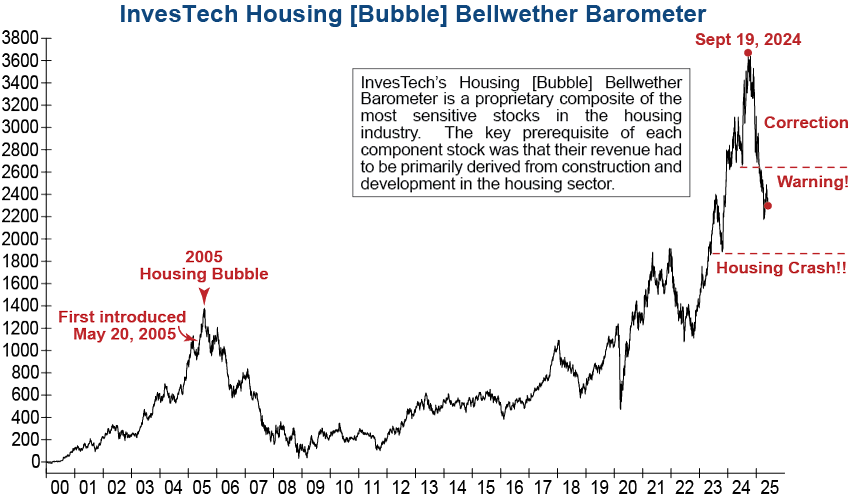

InvesTech’s Housing [Bubble] Bellwether Barometer also continues to show signs of weakness as it remains near its interim low and -37% below its peak from late last year. This leading indicator of the housing sector has seen little to no recovery and remains decisively in warning territory. If it continues to fall and breaks through the second support level it will be a surefire sign of trouble ahead.

The housing market is critical to the economy and investor psychology, and a breakdown in this sector could have a significant impact on broader financial markets.