The rally in the S&P 500 over the past year has been primarily driven by just a handful of mega-cap momentum stocks, while most other stocks have continued to languish well below their 2022 peaks. This dynamic can clearly be seen in the Russell 2000 Index, which is considered to be the premier U.S. small-cap index. After churning sideways for a year-and-a-half, the Russell 2000 has now broken under its June 2022 bear market low (see graph below). Historically, this index losing support has often been a warning sign of additional losses to come. The Russell 2000 reaching a new bear market low shows the significant damage which has occurred under the surface on Wall Street.

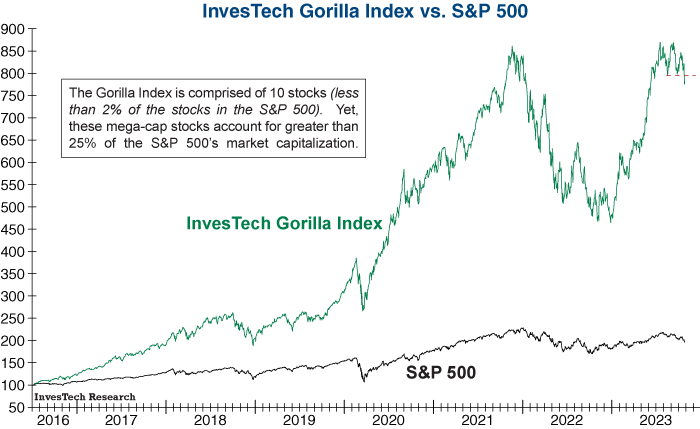

In another worrisome development, our Gorilla Index has broken below a key support level. This indicator tracks the mega-cap momentum darlings of Wall Street, like Apple and Nvidia, which have an outsized effect on investor psychology today. Thus, if the Gorilla Index fails to quickly regain this support level, it would greatly increase the odds that the bear has reemerged.

Both of these developments reaffirm our defensive portfolio positioning as the weight of the evidence continues to erode in this high risk market.