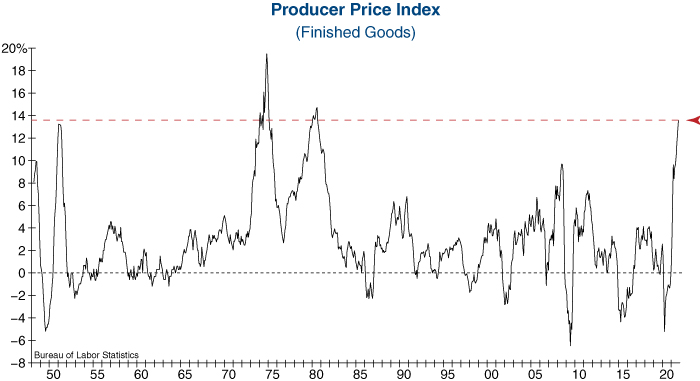

The Producer Price Index (PPI) for Finished Goods continued to surge in November and has now increased by +13.6% from a year ago. This is the hottest PPI reading since the days of double-digit inflation in 1980 and shows that supply/demand imbalances remain in place. Producers continue to get squeezed and must choose between raising their selling prices, letting increased input costs erode their profit margins, or some combination of both.

While we may not expect a hyperinflationary scenario to play out today, this PPI release suggests that there could be continued inflationary pressure flowing through into the Consumer Price Index (CPI) which recently hit a four-decade high. It also places additional pressure on the FOMC -which meets this week- to consider tightening monetary policy faster than expected.