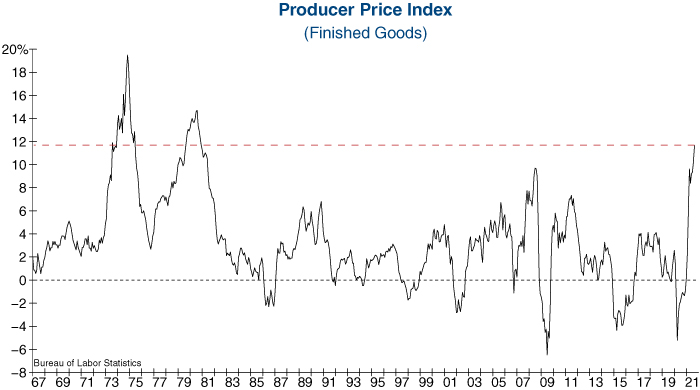

The Producer Price Index (PPI) for Finished Goods climbed from 10.2% to 11.7% in September, the highest reading since November of 1980 (see chart below). This unprecedented rise in input costs is putting companies in a tough position. They either have to raise their selling prices, let increased costs diminish their bottom line, or some combination of both. It should be noted that while initial price increases were limited to big spikes in just a few goods, inflation has since become more broad based.

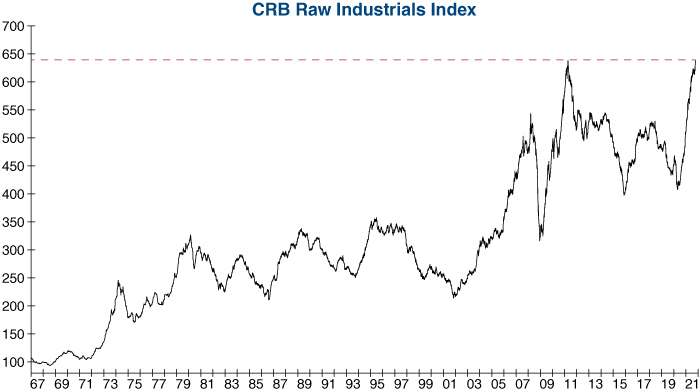

One piece of evidence that shows the broad-based nature of input cost inflation is the CRB Raw Industrials Index, which tracks 13 of the most basic inputs to industrial production. This index has soared following the economic reopening last year and recently reached a record high reading for the first time in over a decade. And as long as this index continues to make new highs, it’s likely that input prices will continue placing upward pressure on inflation as well.