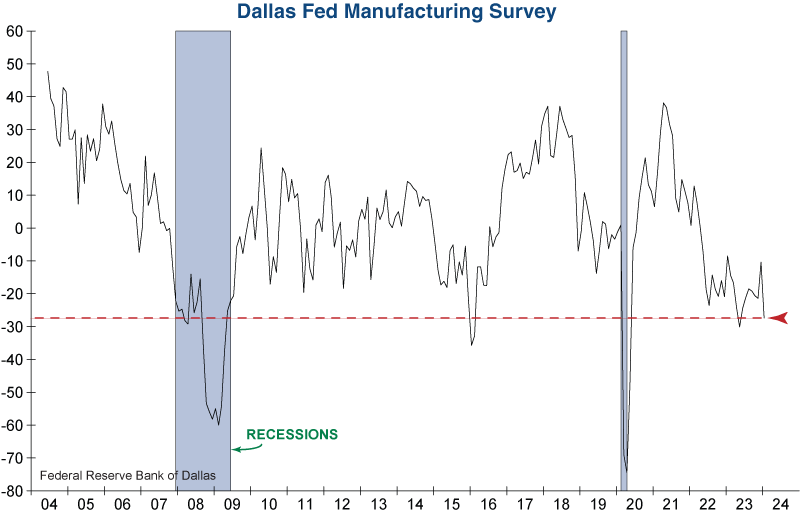

Today’s Texas Manufacturing Outlook Survey from the Federal Reserve Bank of Dallas showed further contraction in January after some improvement in December and was a significant downside surprise compared to forecasts. Many subcomponents of the survey contracted as did the perception of broader business conditions. Here’s an excerpt from the latest report:

“Perceptions of broader business conditions continued to worsen in January. The general business activity index fell from -10.4 to -27.4, and the company outlook index fell from -9.4 to -18.2. The outlook uncertainty index held fairly steady at 20.9.

Labor market measures suggested employment declines and shorter workweeks in January. The employment index moved down seven points to -9.7, its lowest reading since mid-2020. Fourteen percent of firms noted net hiring, while 23 percent noted net layoffs. The hours worked index came in at -11.8 after a near-zero reading last month.”

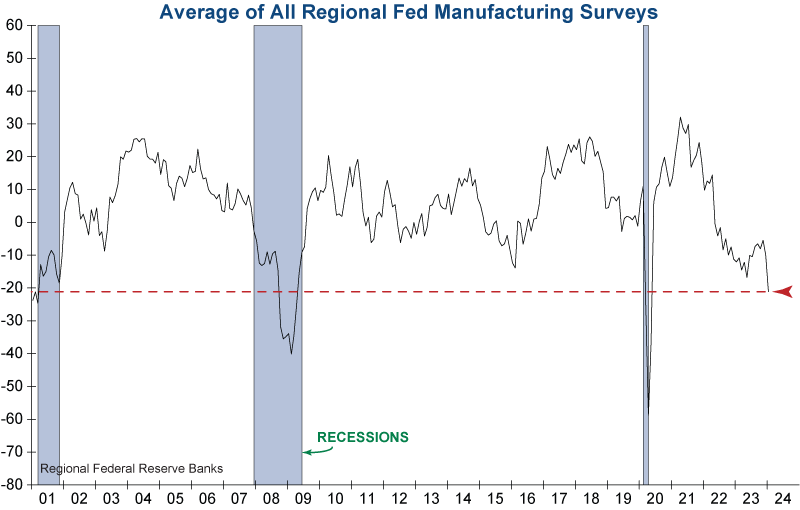

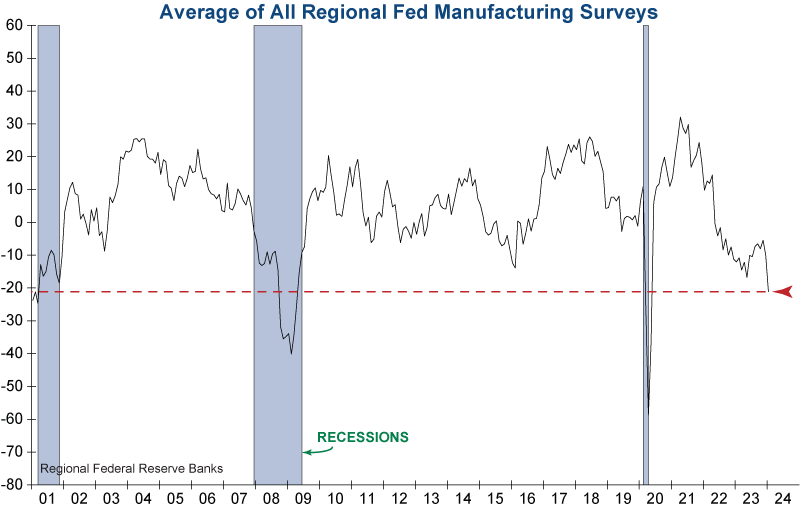

When looked at in isolation, the state of manufacturing in the Dallas region may seem detached. However, when looked at along with the four other regional Federal Reserve Bank manufacturing surveys, it can be seen as an overview of the state of manufacturing nationwide.

Five regional Federal Reserve banks have manufacturing surveys that are tracked monthly to assess prices, labor, inventory, revenue, sales, and credit, among other topics. These represent the broader geography in the Central bank’s regions and include Richmond, Philadelphia, Kansas City, New York, and Dallas.

All five regional surveys showed significant contraction for the month of January fully offsetting the temporary improvement that took place during the latter part of 2023. When looking at the average of these five surveys over time, there is no doubt that manufacturing is truly struggling. Today’s average is now far below its prepandemic norm and showing widespread weakness that has only been seen during a recession.

While the US economy is predominantly services-based, a severe and widespread slowdown in manufacturing will still have reverberations through the broader economy and carry implications for both growth and hiring.