The seemingly strong consumer has been the lifeblood of this two year expansion. However, we continue to see signs that U.S. consumers are becoming increasingly stressed. Today’s earnings report from Target showed weakening sales, underscoring this financial strain. In contrast, lower-cost discount stores have been faring better. Specifically, Walmart dramatically beat Q3 earnings, even raising their guidance for next year.

“Target shares plunge 21% after discounter cuts forecast, posts biggest earnings miss in two years”

– CNBC, November 20, 2024

“Bargain-hungry shoppers prove choosy about where to spend their holiday dollars”

– NBC News, November 20, 2024

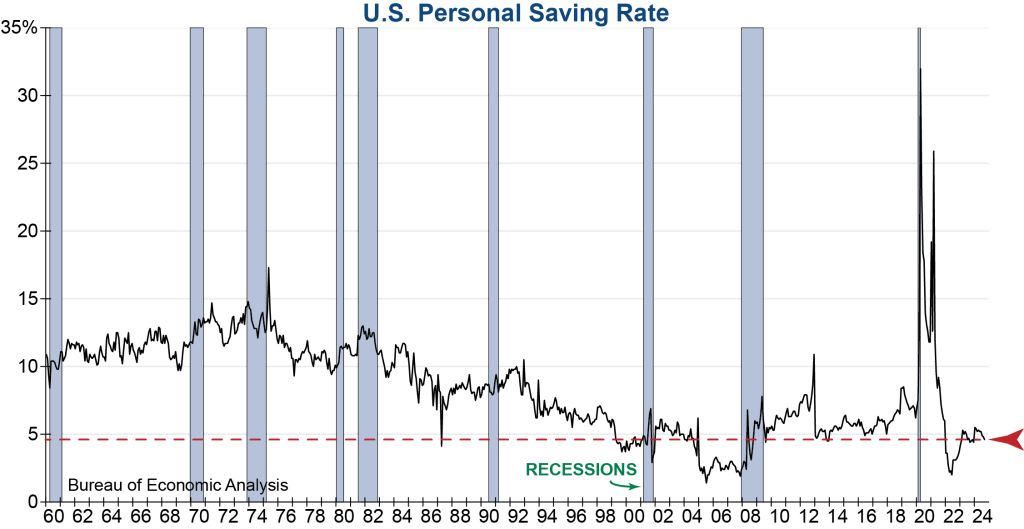

While consumers are still spending, much of it appears to be borrowed. Once a buffer for many households, savings accrued during the pandemic is by now likely exhausted. The Personal Saving Rate, which is the percentage of income remaining after taxes and spending, recently hit its lowest level of the year (see graph below) and remains depressed relative to history – a worrying trend that is heading in the wrong direction.

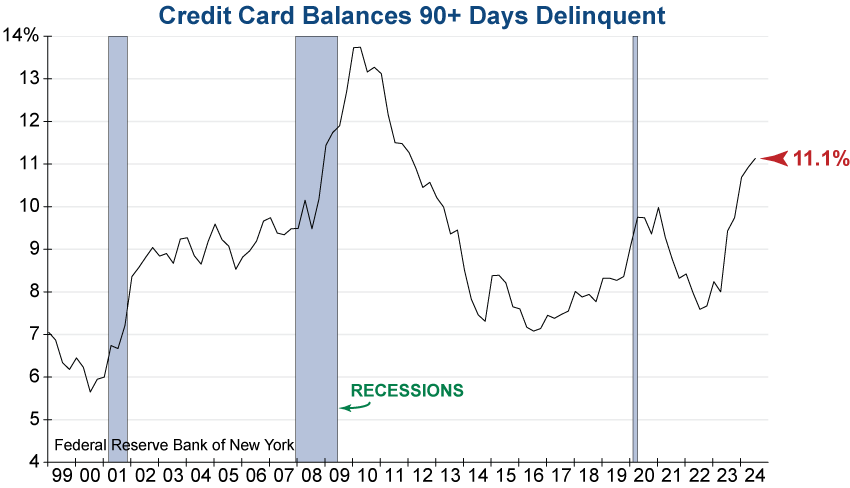

Most importantly (and troubling) are serious delinquencies (90+ days) on credit card borrowing, which have surged since late last year and recently reached their highest level since 2012. Despite a shorter data history, it is concerning that current delinquencies are near figures last seen just after the Great Financial Crisis. One can’t help but wonder how bad this could get if or when an economic recession finally hits.

The end of the calendar year is typically marked by strong consumer spending on all-important Black Friday and holiday season purchases. However, given the financial strain on consumers, that may not be the case this year as current trends point to cautious and debt-driven holiday spending.

These developments, while not a signal of imminent danger, are a notable cause for concern as they paint a precarious picture for the consumer-driven areas of the economy moving forward.