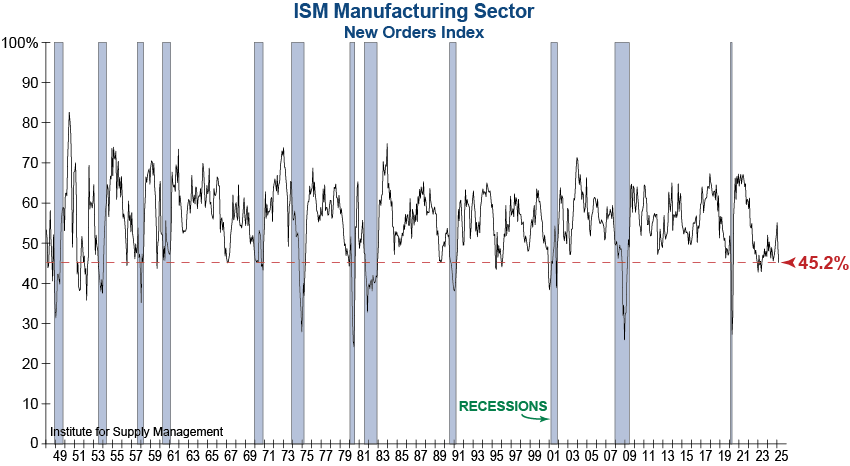

This morning’s report from the Institute for Supply Management on Manufacturing showed that the two-month recovery of manufacturing activity proved to be brief, with leading components flashing warning signals.

The New Orders Index, which tends to be more forward looking than the Overall Index, showed significant weakness in March, dropping to its lowest level in 22 months. It contracted for the second month in a row following a brief period of strength. The Index now sits at 45.2%, indicating that new orders are decreasing faster as economic uncertainty is creating challenges in the current business environment.

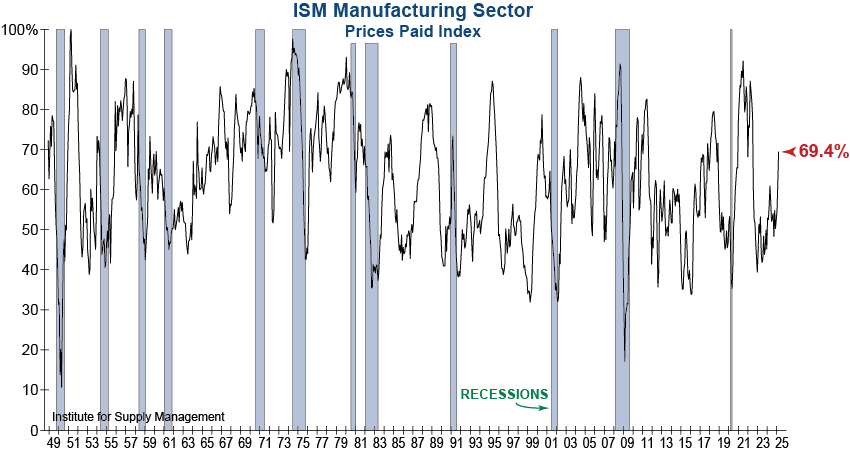

The most dramatic, and most concerning, move in the report was the leap in the Prices Paid Index. The Index rose 7 percentage points and now sits at 69.4%, indicating that price pressures in the Manufacturing sector are increasing at a faster rate. This price growth is attributed to tariffs –both those implemented and uncertainty regarding more in the future.

While manufacturing only accounts for approximately one third of the US economy, falling growth in conjunction with escalating prices will likely have negative impacts on the broader economy and overall inflation. Moreover, reheating inflation reduces the likelihood of the Fed cutting rates as much as investors had hoped, further muddying the path forward for monetary policy.