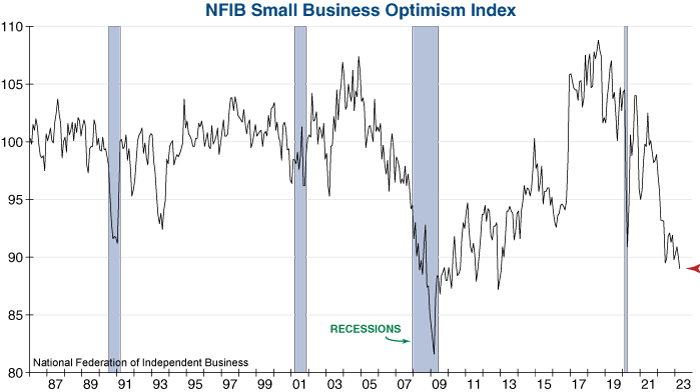

The National Federation of Independent Business (NFIB) reported that its Small Business Optimism Index fell by 1.1 points to 89.0 in April, the lowest reading since January 2013. Small businesses reported that they continue to face many problems – including inflation, labor cost and quality, and deteriorating customer demand. As a result, small business owners are now taking steps to hunker down in anticipation of hard times ahead…

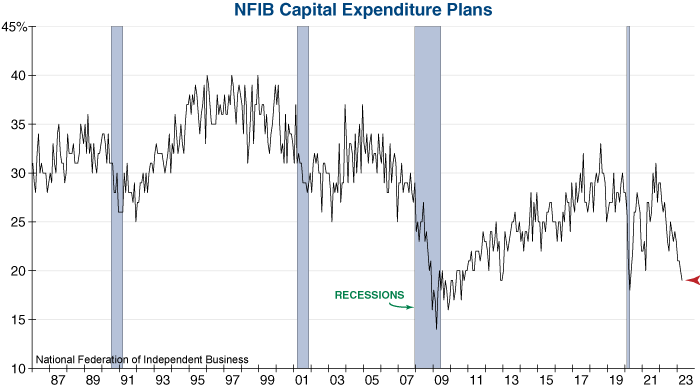

One way small businesses are preparing for a potential economic slowdown is by cutting their capital expenditure plans. Just 19% of small business owners have plans for a capital outlay in the next three to six months – one of the lowest readings in the survey’s four-decade history. This clearly shows a lack of confidence in future conditions, and another recent survey highlights that small businesses aren’t alone in feeling this way.

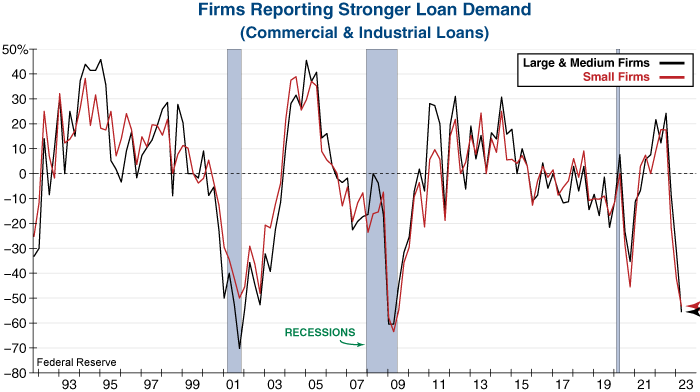

Yesterday, the Federal Reserve released their quarterly Senior Loan Officer Opinion Survey which showed that both small and large businesses are significantly cutting back on their borrowing activity. As shown in the graph below, loan demand for all business sizes just cratered to its lowest level since the 2008 Financial Crisis. This decline in demand was due in part to higher interest rates and tightening lending standards, however a pessimistic business outlook and lower capital expenditure activity also contributed to the drop.

No matter how you cut it, weakening credit demand and capital expenditure activity is a worrisome development for the U.S. economy and it will have recessionary implications if it persists.

Eli Petropoulos, CFA – Sr. Market Analyst