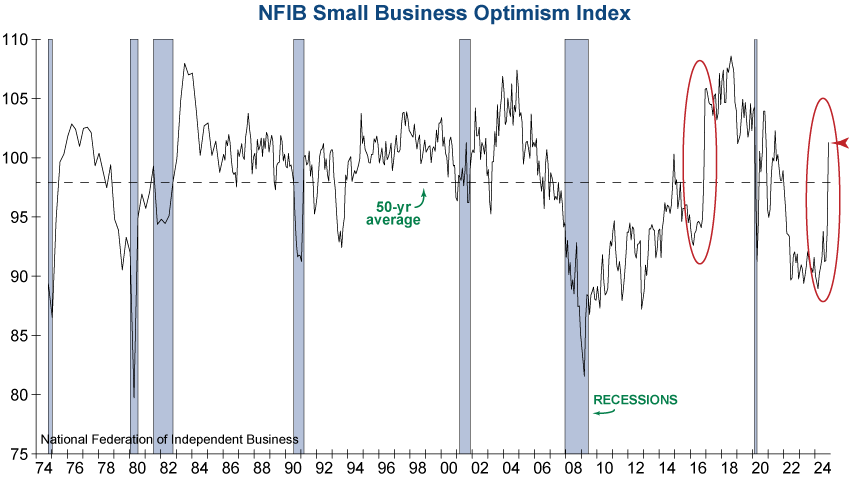

The latest Small Business Optimism Index from the National Federation of Independent Businesses (NFIB) surged eight points in November, its highest reading since June 2021. Nine of the ten subcomponents increased and for the first time in nearly three years, the Index surpassed its 50-year average of 98.0.

November’s sharp increase can be attributed to the Presidential Election results, which signals a major shift in economic policy. This anticipation of economic growth is driven by pro-business policy under the new administration that includes deregulation, tax reforms, and support for domestic energy production.

A similar surge in Small Business Optimism occurred in 2016 following the election of Donald Trump. Much like today, the post-election euphoria was driven by anticipated pro-business policies. In our November issue of InvesTech Research, we explored the comparison between the first Trump term and the current environment, identifying both similarities and a few key differences.

The market environment today is significantly more stretched than it was in 2016, which highlights the many risks, including valuation concentration and higher interest rates. Valuations are meaningfully higher than in 2016, especially the Price-to-Earnings and Price-to-Sales ratios (see table below). In addition, interest rates today are vastly elevated.

While businesses are optimistic about another Trump administration, economic conditions are considerably more complex and many challenges remain. The November NFIB report showed that the Single Most Important Problem remains inflation, which continues to be stubbornly above the Federal Reserve’s 2% target. This concern about inflationary pressures also reminds us of another lesson from the past, highlighted on Page 8’s Personal Perspective in last month’s issue.

Only time will tell if optimism among small business owners will result in additional economic growth and stock market gains. But for now, sentiment says ‘no recession ahead.’ However, today’s environment is far riskier than in 2016, which is why we continue to encourage investors to give this bull market a healthy benefit of doubt while keeping one eye on the exit and a foot in the door.