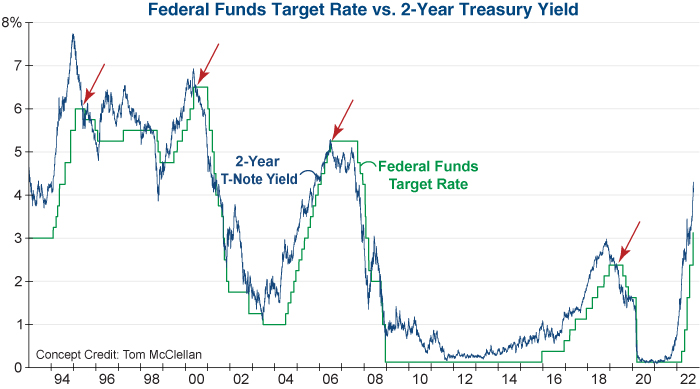

Interest rates have continued to surge as investors come to accept that persistent inflationary pressures will bring further tightening from the Federal Reserve. Looking ahead, the difference between the 2-year Treasury yield and the Federal Funds Target Rate can be useful for gauging monetary conditions and future Fed actions. Historically, monetary tightening cycles have not ended until the 2-year Treasury yield and the Fed Funds Target Rate converge (red arrows on graph). Today, with the 2-year Treasury yield remaining more than a full percent above the current Fed Funds Rate, it’s likely that additional rate hikes lie ahead – representing a continued headwind for the stock market.

Eli Petropoulos, CFA – Sr. Market Analyst