Updated October 24, 2025

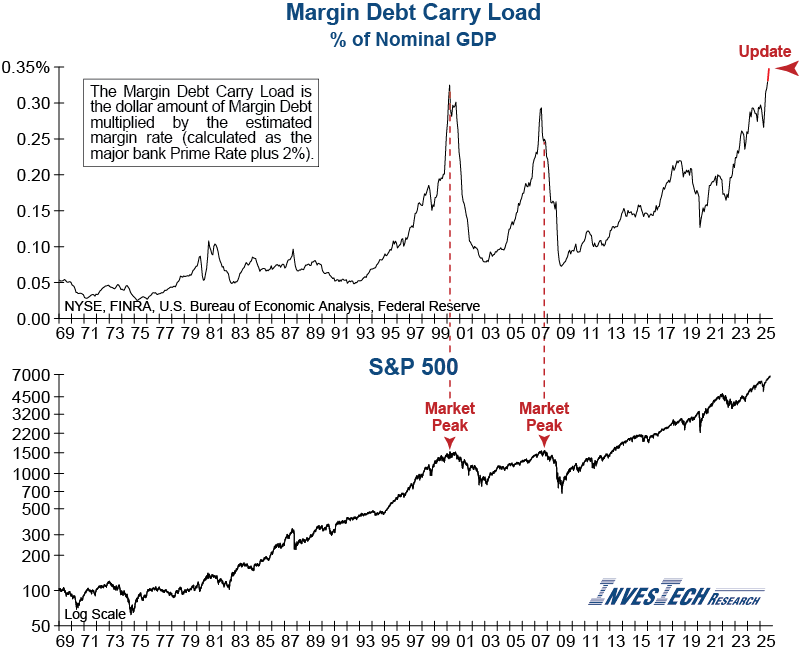

In the September release, margin debt increased by nearly $40 billion, pushing the Margin Debt Carry Load to the highest level on record and ringing alarm bells for the level of risk in the market.

Margin debt represents the amount of money borrowed by investors to buy stocks on margin, and it has mattered historically for two reasons.

- First, it’s a measurable indication of the public’s appetite for risk and the degree of speculation in the equity market.

- Second, it represents “hot money” – or the funds that will head for the exit quickly at the earliest sign of trouble or when margin calls hit and leveraged positions must be sold.

We calculate the Margin Debt Carry Load by multiplying margin debt by an estimated margin rate (the major bank prime rate as reported by the Federal Reserve plus 2%). The result gives us a conservative estimate of the actual cost to maintain margin, which we look at as a percentage of GDP to put the figure in historical context.

Large multi-year increases in margin debt —especially in the face of high borrowing costs— often precede major market tops. The only times this indicator even came close to the current level were the 2000 Tech Bubble and the Great Financial Crisis in 2007. The parabolic rise in this indicator tells us that speculation is rapidly increasing. And with borrowing costs so high, it also tells us that a respect for risk is virtually nonexistent. With the level of margin debt —and by extension investor speculation— so high, there is the potential for the market to unwind quickly and dramatically as investor psychology falls back to earth.

The October release of Margin Debt shot up to $1.13 trillion, lifting the Margin Debt Carry Load (as a % of GDP) to a new all-time high (red on graph). This near-vertical rise eerily resembles major market peaks of the past, and reminds us this is not a low risk investing environment.