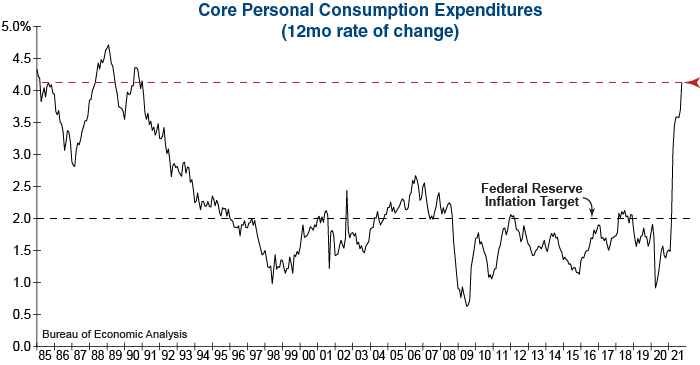

Core Personal Consumption Expenditures (PCE), which excludes volatile food and energy prices, climbed even further beyond the Federal Reserve’s 2.0% inflation target in October (see graph below). Core PCE –the Fed’s preferred inflation measure– rose to 4.1% from 3.7% the month prior, putting increasing pressure on central bank officials to tighten monetary policy to alleviate mounting pricing pressures.

Furthermore, inflationary fears kept Consumer Sentiment below last year’s pandemic lows in November’s final reading. As stated by the University of Michigan in today’s Sentiment report: “The decline was due to a combination of rapidly escalating inflation combined with the absence of federal policies that would effectively redress the inflationary damage to household budgets.” Inflation is top-of-mind for consumers as we head into the holiday season. If an inflationary psychology becomes ingrained, pricing pressures can become self-perpetuating – which increases the risk that inflation will be hotter and stickier than the Federal Reserve has forecasted.