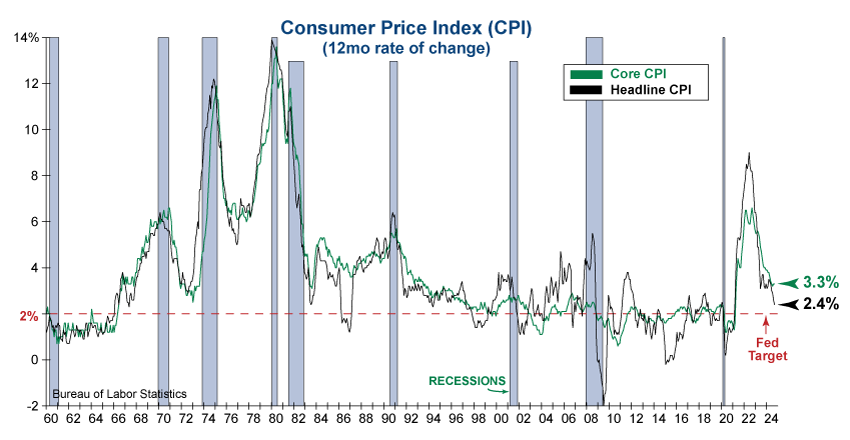

This morning’s Consumer Price Index (CPI) for September came in at 2.4%, lower than the previous month, but higher than expected.

Core CPI, which removes volatile food and energy components, came in at 3.3% and was also higher than forecast. The majority of this increase was due to unrelenting shelter costs, which have increased 4.9% year-over-year. Other notable items that contributed to the hotter-than-expected print were car insurance, which has seen dramatic inflation over the last year, medical care, and apparel.

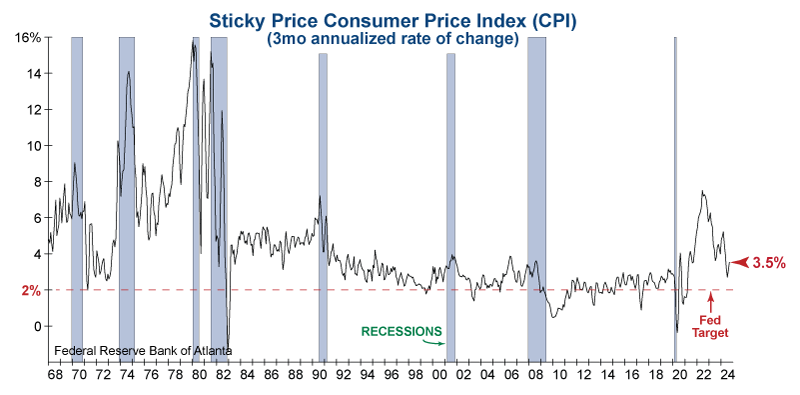

Sticky components of inflation, like shelter and car insurance, are falling much more slowly and remain substantially above the Fed’s 2.0% target. The latest Sticky-Price CPI reading showed a continued upward move in the 3-month annualized rate, which has accelerated from 2.7% to 3.5% over the last couple of months, indicating signs of a potential reheating.

Today’s CPI data suggests the Fed’s goal of maintaining stable prices–and the all clear to deliver aggressive monetary easing–seems to be getting harder. If inflation remains stubborn in the months ahead, it puts the Fed between a rock and a hard place.