Earlier this week, the S&P 500 gained over +5.7% in just two days as poor macroeconomic data spurred hopes of a policy pivot from the Federal Reserve. One datapoint that led to the equity market rally was job openings, which plunged by the second-largest amount on record at -1.1 million openings. The only month that had more lost job openings was during the pandemic-related shutdowns in April 2020. This surprisingly negative report highlighted an increased risk of recession, causing many to speculate that Fed officials would reconsider further monetary tightening. However, the most important data to the Federal Reserve is keeping them on a tightening course…

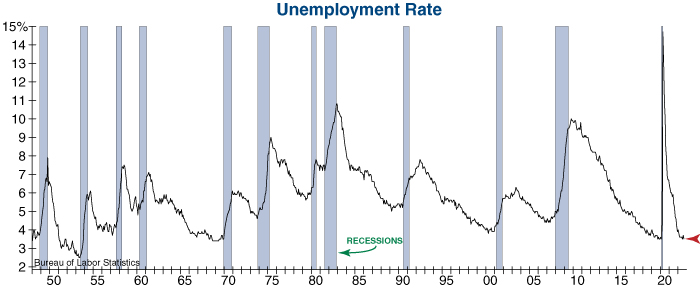

Today’s employment report from the Bureau of Labor Statistics (BLS) showed some softening with non-farm payroll growth of +263K – the lowest since April 2021. Yet the unemployment rate fell back near its 50-year low of 3.5%, crushing the hopes of an upcoming Fed pivot. The BLS report also showed that there are still more than 1.5 job openings for every unemployed person, which should keep wage inflation at an elevated level until this dislocation is resolved.

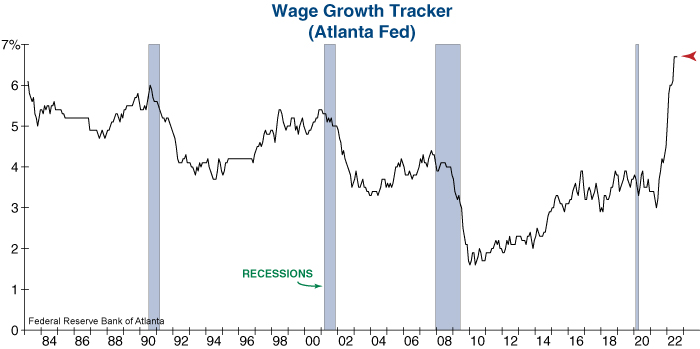

Furthermore, the Federal Reserve’s own data shows the danger of a wage-price spiral is far from over. As shown in the graph below, the Atlanta Fed’s Wage Growth Tracker remains at the highest level in its near 40 years of data at 6.7%. Wages are perhaps the stickiest and most important factor for inflation, and they are followed closely by the FOMC for this reason.

So, while the labor market is weakening and recession risk is rising, key unemployment and wage data will keep the Federal Reserve tightening monetary policy for the foreseeable future.

Eli Petropoulos, CFA – Sr. Market Analyst