Heading into the Fed Rate decision today, markets are pricing in a 90% probability of a rate cut according to Fed Funds Futures from CME FedWatch. This probability has been increasing over the last couple of weeks as recent economic data points depict a weakening labor market and inflationary pressures that appear to have stabilized.

If —and likely when— the Fed lowers rates today, it will be the 6th rate cut event of the current cycle. (Note: A rate cut event is defined as the decision to cut regardless of the amount.)

So, here’s what you need to know:

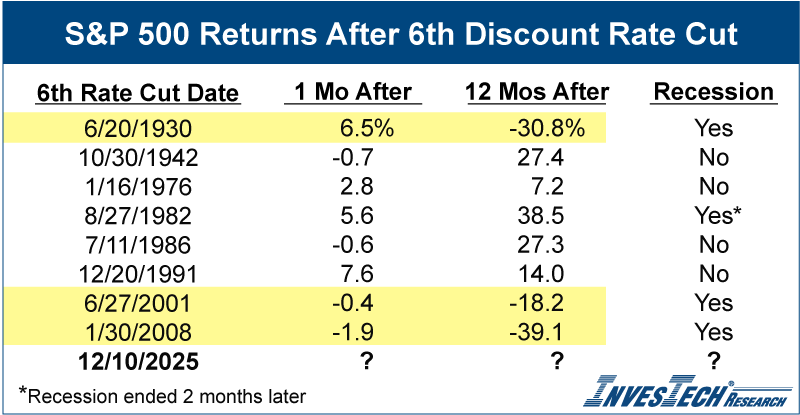

- Fed easing is historically and correctly considered favorable for the stock market outlook. As shown in the table below, the majority of the time when the Fed cuts rates for the 6th time, the market moves higher in the near and long term. The historical fact is this week’s rate cut favors the bulls.

- Fed easing, however, is not favorable for the stock market in scenarios when high valuations are unwinding. In scenarios when the Fed battles not only inflation, but they also attempt to sustain or prevent the popping and deflating of a bubble in stocks like 1929 & 2000 or housing in 2008 (see highlighted rows in table below), lower rates are not enough to stall the fallout in the stock market.

A cut this week may continue to help short-term stability – at least for now. However, if air starts to come out of the bubble once again, then even the Fed can’t prevent the inevitable unwind. We will keep a close eye on our AI Index, Gorilla Index, and Housing [Bubble] Barometer for early warning signs that this rate cut has only temporarily stalled the deflating of a valuation bubble.