Wall Street and main street alike have become increasingly optimistic about the possibility of a soft landing for the U.S. economy:

Confidence grows that Federal Reserve can deliver a soft landing for US economy -Financial Times, 7/29/2023

While investors cheer for a Goldilocks scenario, the economic data paints a still worrisome picture.

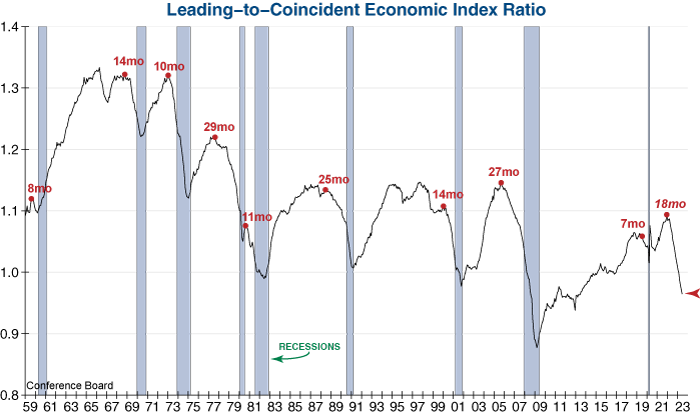

The Conference Board produces composite indexes of leading, coincident, and lagging indicators. Historically, turning points in the leading index have occurred before changes in the economy, while turning points in the coincident index have occurred at about the same time as economic activity.

While the coincident data remains strong, as evidenced by the Coincident Economic Index (CEI), the leading data continues to deteriorate as the Leading Economic Index (LEI) has declined for an astonishing 15 consecutive months.

When the LEI declines significantly relative to the CEI, it has historically marked recessionary periods (see graph below). The LEI-to-CEI ratio has been in decline for the past 18 months –slightly longer than the average recession lead time of 16 months– but still less than three of the nine prior instances. This historically reliable tool clearly indicates that economic pain still lies ahead.

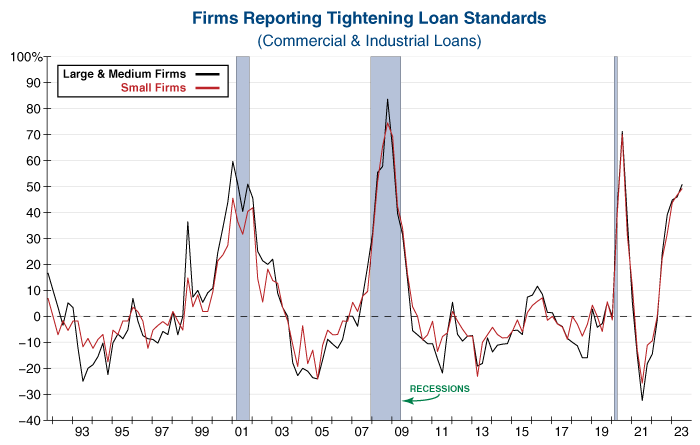

Furthermore, the most recent update to the Senior Loan Officer Opinion Survey (SLOOS) from the Federal Reserve shows the central bank’s tightening campaign is taking a serious toll. Today’s release showed that lending standards remain historically tight, as banks reported stricter lending standards for all consumer loan categories. Economic growth is largely dependent on businesses and consumers being able to secure loans and access credit, therefore banks becoming more restrictive in their lending standards will continue to be a headwind to future growth.

All in all, the weight of the evidence continues to indicate that it’s a matter of when, not if, the U.S. will fall into recession.