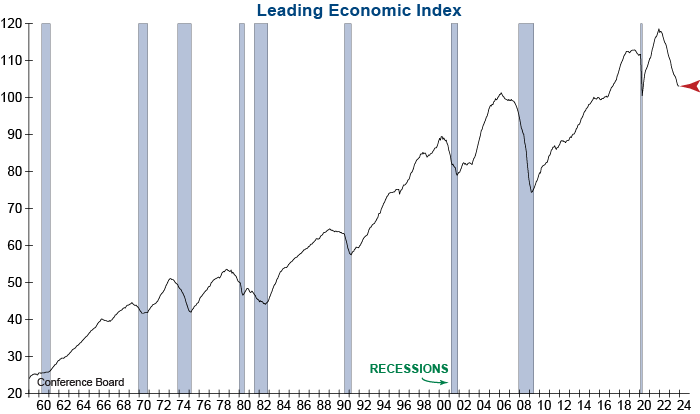

Yesterday, the latest data for the Conference Board’s Leading Economic Indicator (LEI) was released for December. December saw a 0.1% decrease for its 22nd consecutive month after falling 0.5% in November. Benchmark revisions were made going back to the start of the series. Here’s an excerpt from the latest press release:

“Despite the overall decline, six out of ten leading indicators made positive contributions to the LEI in December. Nonetheless, these improvements were more than offset by weak conditions in manufacturing, the high interest-rate environment, and low consumer confidence. As the magnitude of monthly declines has lessened, the LEI’s six-month and twelve-month growth rates have turned upward but remain negative, continuing to signal the risk of recession ahead. Overall, we expect GDP growth to turn negative in Q2 and Q3 of 2024 but begin to recover late in the year.”(bolding InvesTech’s).

We couldn’t have said it better ourselves, but despite the better-than-expected report, the LEI is still in decline, just at a slower rate. It is also worth mentioning that if you exclude the positive impact of the year-end stock market rally (Financial Component – S&P 500 Index of Stock Prices) the LEI would have declined -0.3% in December.

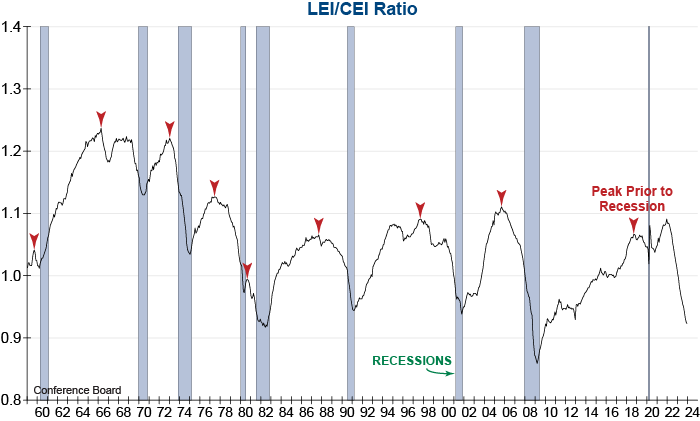

Additionally, the ratio of Leading to Coincident Economic Indicators has been inching closer to its longest decline on record (during the Great Financial Crisis).

Though a slowing decline in the LEI is seen as an improvement, we cannot ignore the signal this long-standing indicator has given for a near-record length of time. It will be important to watch in the months ahead.