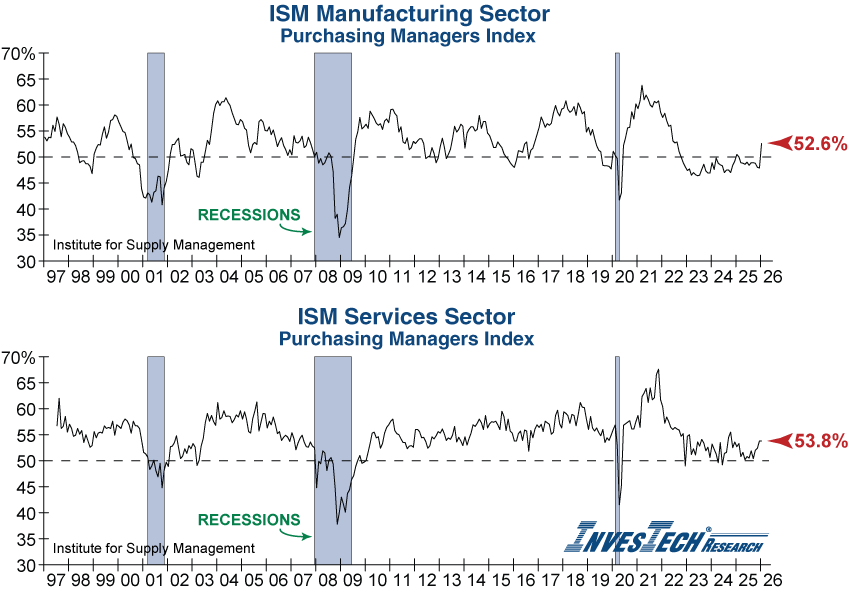

Both the Institute for Supply Management (ISM) Manufacturing and Services Reports were released this week showing positive developments. However, trouble lurked beneath the surface…

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers Index (PMI) rose far more than expected in January from 47.9% to 52.6%, hitting its highest level since late 2022. This was the manufacturing sector’s first month in expansion (>50%) in nearly a year. While the headline numbers were a notable improvement, comments from respondents were decisively negative. Professionals within the industry cited soft business conditions, economic uncertainty, cautious consumers, and tariff confusion as significantly weighing down their businesses. Meanwhile, the ISM Services PMI was unchanged at 53.8% as the service sector remained in expansion.

While the economic strength depicted by both the manufacturing and service sectors expanding is promising, the Prices Index rose for both, exposing rising price pressures.

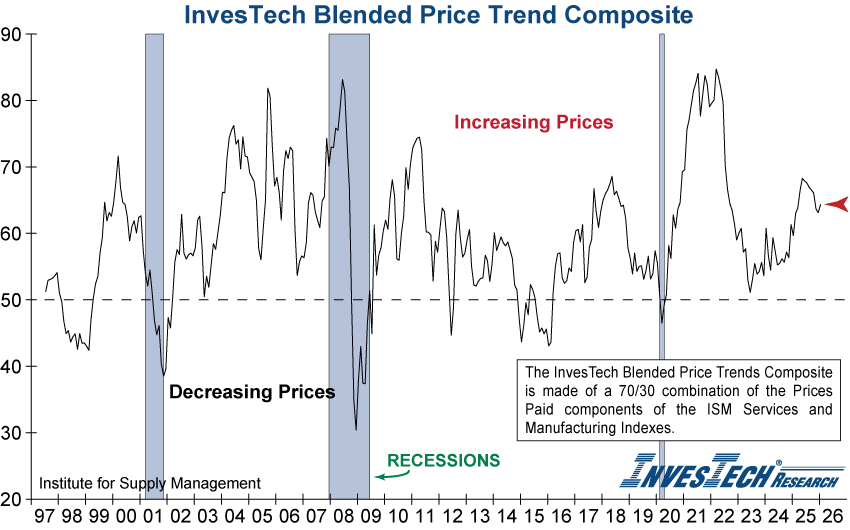

We created the InvesTech Blended Price Trend Composite to monitor how the price increases across both sectors impact the overall economy. This composite looks at a combination of the Prices Index from the reports with the Services Prices Index accounting for 70% while Manufacturing accounts for 30% to reflect their approximate contribution to the U.S economy. This rose from 63.1% to 64.3%, indicating that prices are increasing at a faster pace than the prior reading. The faster price growth noted by executives could translate into higher inflation, which would force the Fed to reevaluate their ability to cut rates this year as they balance a cooling labor market and sticky prices. In fact, the probability of a rate cut at the next Fed meeting in March has already fallen from over 50% a month ago to just 10% as implied by Fed Funds Futures.