Welcome!

Welcome to InvesTech Research and congratulations on joining the elite group of investors who utilize InvesTech’s unique safety-first profit strategy.

As a new subscriber, you should initially focus your attention on the portions of the newsletter with which you feel comfortable. It’s not important that you understand our technical indicators or the ins and outs of the Federal Reserve in order to profitably utilize our safety-first strategy. Investing in the stock market is a learning experience…and a long-term commitment. Within a matter of months, we’re confident you’ll begin to feel more at ease with the detailed analysis which has earned InvesTech its reputation as one of the nation’s leading advisory services.

Your next step to becoming familiar with what InvesTech has to offer is to set up your email preferences. To select which notifications you would like to receive, simply navigate to the Email Notifications section in your My Account area, or click here.

Helpful Resources

In our Subscriber Library, you’ll find everything you need to get started with InvesTech’s safety-first profit strategy. Read about our InvesTech Indicators, how to use Bear Funds, and more. We recommend starting with the InvesTech Research Personal Profit Guide and How to Use the InvesTech Model Fund Portfolio to quickly help you come up to speed on InvesTech’s approach:

Subscriber Tools

Your subscription also includes vital tools to help you stay up to date with all of the analysis and recommendations InvesTech provides. Under the “Subscriber Services” tab, you’ll find a collection of subscriber resources and tools, including:

InvesTech Subscription Information

InvesTech Research publishes the monthly newsletter on the third Friday of every month. Your subscription will begin with the issue published during the month your subscription order was received. Your subscription also includes complimentary access to the last several months of issues, found on the Latest Issues page. Click below to view our publication schedule for the entire year at a glance:

InvesTech Publication Calendar

Money Back Guarantee: If you choose to cancel your subscription for any reason, you will receive a full refund on all remaining issues.

Read the January Issue of the InvesTech Research Newsletter!

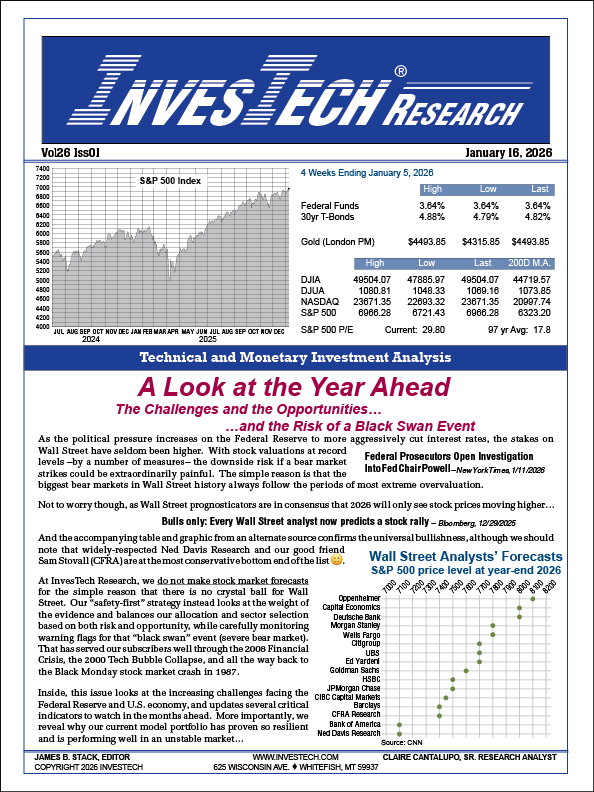

A Look at the Year Ahead

The challenges, opportunities, and the risk of a black swan event!

As political pressures increase on the Federal Reserve to more aggressively cut interest rates, Wall Street sits on unsteady ground. And with stock valuations at all-time highs by multiple measures, the downside risk could be severe…

So, in our latest issue of InvesTech Research:

- We evaluate the biggest challenges facing the U.S. stock market and economy in 2026.

- We reveal the key opportunities for profit in the year ahead.

- And we expose how the multitude of extremes present today raise the stakes for investors.

Don’t miss this critical issue of InvesTech Research. Click below to read!

Frequently Asked Questions

How do I find My Account dashboard?

Your “My Account” dashboard is where you can find all of your account and subscription information. Start by logging in and selecting the green “My Account” button in the right hand corner. This will open your account dashboard where you can edit your profile settings, adjust your payment information, and more.

How do I renew my subscription?

Renew your subscription by navigating to your My Account dashboard and selecting “renew” if you have an active subscription, or “+ New Subscription” if your subscription has expired.

How do I change my password?

Change your password by navigating to your My Account dashboard and selecting the “My profile” section. From here, you can select the “Change Password” button.

How can I get notified when new content is available?

Sign up to receive email notifications when the latest newsletter is published, a Market Insight is posted, there is a change to the Model Fund Portfolio, or a Weekly Hotline is available. You can choose which emails you would like to receive by navigating to “Email Preferences” in your My Account dashboard.

How do I utilize the Model Fund Portfolio?

To best utilize the Model Fund Portfolio, you should attempt to bring your portfolio into alignment with the Model Fund Portfolio’s allocation as quickly as possible. We recommend viewing the “How to Use the InvesTech Model Fund Portfolio” article in the Subscriber Library. In general, we recommend you first determine your current invested allocation, and then refer to the InvesTech model fund portfolio. Lastly, we suggest you adjust your portfolio to align with the model fund, phasing into the market over about 2 months. Purchases after our initial recommendations must be made at your discretion.

How does InvesTech select ETFs and Mutual Funds to recommend?

We follow these criteria when choosing ETFs: They have at least $200 million in assets and adequate trading liquidity. They hold all or most of the securities in the index they are designed to follow. Additionally, we look for those that have at least a 5-year track record. Lastly, we choose funds that are sponsored by industry leaders and have expense ratios of less than the industry average.

The first criterion for mutual funds is a performance record which ranks among the top funds in its category. In addition, the fund should be no-load or low-load. It also must be easily switchable online or via phone either directly through a fund family or a brokerage service. We also look at the fund’s size, annual portfolio turnover, and expense ratio, among other attributes.

We recommend funds based on InvesTech’s independent stock market research and analysis and ensure they align with our safety-first strategy.

Subscriber Support

We are here to assist you. Call our office at 406-862-7777 or request assistance using our Contact form.