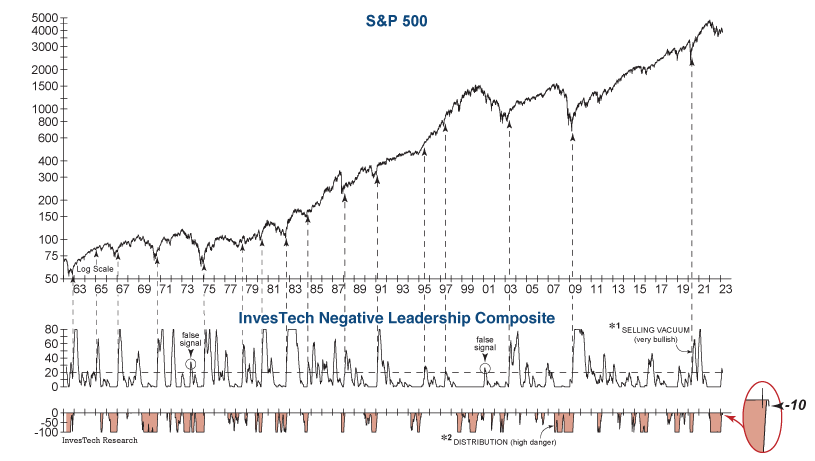

The bearish Distribution component of our Negative Leadership Composite (NLC) has made a sudden reemergence after its month-long absence and now stands at a reading of -10. Historically, Distribution reemergence after the S&P 500 is in bear market territory increases the probability that the bear market remains intact. This was the case during the extended 1973-74, 2000-02, and 2007-09 bear markets, and today’s bearish signal could suggest that further weakness lies ahead for the stock market. If Distribution continues to build in the days or weeks ahead, additional defensive adjustments will likely be required in the Model Fund Portfolio. Stay tuned…

Eli Petropoulos, CFA – Sr. Market Analyst