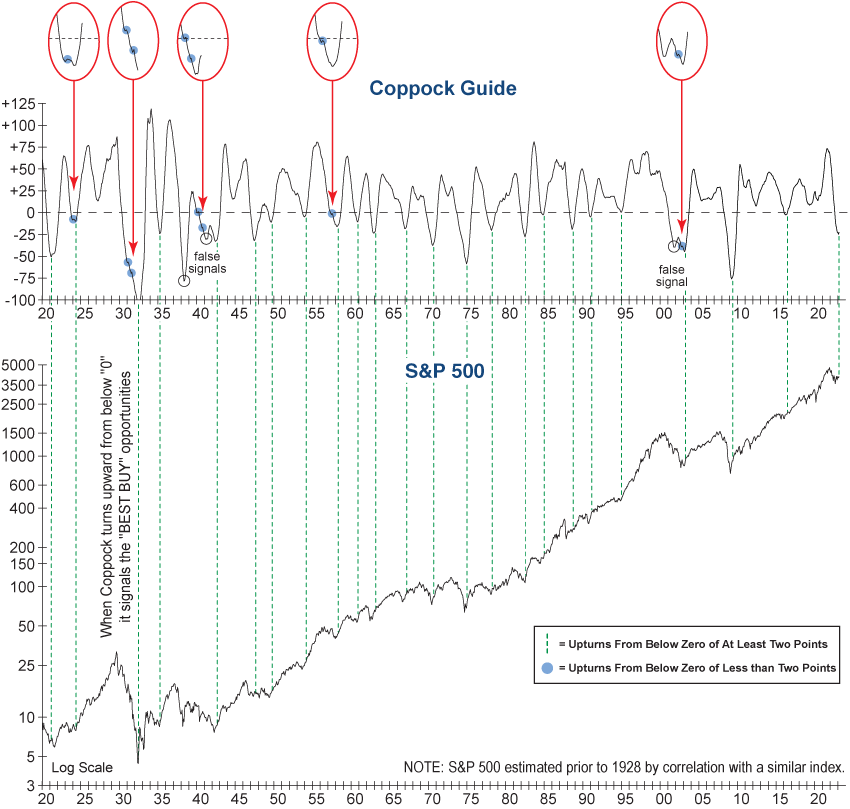

The Coppock Guide has a stellar reputation as being one of the most reliable technical tools for identifying long-term buying opportunities in the stock market. Often referred to as a “barometer of the market’s emotional state”, the Coppock Guide is technically an oscillator that changes direction based on longer-term trends in a stock market index. It is not useful in predicting bull market tops, which typically take time to unfold – the true value of this indicator is at market bottoms, where it has confirmed almost every new bull market over the past 100+ years with only three false signals (1938, 1941, 2001). We consider a buy signal in the Coppock Guide to be any definitive upturn from a reading at or below zero. As of market close on March 31, the Coppock Guide inched higher from a negative reading. However, there is reason to view this potentially positive signal with a degree of skepticism.

The graph below shows the historical reliability of these buy signals, but also shows why it’s worth waiting for a more defined upturn before making any drastic portfolio changes. Minute upturns can occur during extended bear markets as shown by the blue dots in the graph. Today’s upturn is hardly perceptible at this point, and to have a strong degree of confidence in a potential new bull market, we need the Coppock Guide to continue higher along with confirmation from the rest of the technical evidence.

Our Negative Leadership Composite (NLC), an InvesTech Research indicator, typically also has an upward trajectory that accompanies Coppock Guide upturns. However, we are viewing the latest signal with a critical eye. The bearish Distribution component of our NLC has reemerged over the past three weeks, and the bullish Selling Vacuum component has stalled out after surpassing the +20 threshold in February. Neither component has gained firm control as the bulls and bears continue to battle for the upper hand.

There remain many overarching risks in this environment including restrictive monetary policy, an overinflated housing market, and historically elevated stock market valuations. These risks are not characteristic of past “best buy” opportunities confirmed by the Coppock Guide.

Historically, the Coppock Guide has been an extremely valuable technical tool – but there is no Holy Grail. While the upturn in the Coppock Guide is a positive development, we remain patient and are watching for confirmation from the weight of the evidence before making any major strategic adjustments to the Model Fund Portfolio. Given our “safety first” investment strategy, there is little harm in waiting for a more decisive upturn and additional evidence to confirm that bull market gains do indeed lie ahead.

Eli Petropoulos, CFA – Sr. Market Analyst