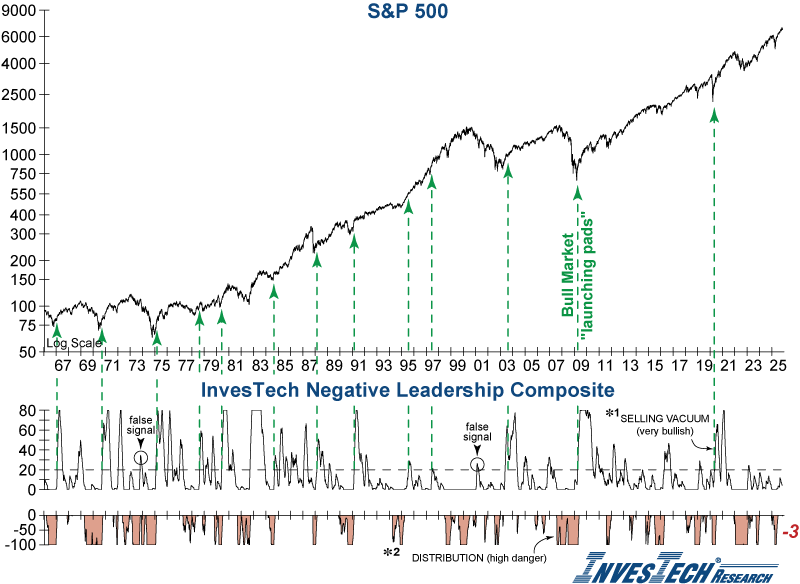

Perhaps the most important indicator to watch in the weeks immediately ahead will be our Negative Leadership Composite (NLC)…

InvesTech Research Special Report – November 3, 2025

We are already seeing internal deterioration in the NLC on a daily basis, which could trigger bearish Distribution within the next several weeks.

This confirmation has arrived – as of today’s close, the NLC is now registering -3 Distribution. This warning last emerged in December 2024 when the NLC dutifully warned us of the near-20% downturn in the U.S. stock market early this year, and this renewed signal is an important new warning sign.

The triggering of Distribution indicates an acceleration in downside leadership and signifies that the stock market has entered dangerous territory. The InvesTech Model Fund Portfolio is positioned to weather this likely storm with our defensive allocation, a large cash reserve and intermediate bond holding, plus a bear market hedge position in an inverse index fund.

InvesTech’s Negative Leadership Composite (NLC) is one of our key proprietary indicators, designed to track market leadership. It is made up of two distinct components: the bullish Selling Vacuum and bearish Distribution. Bearish Distribution measures the rate of acceleration in downside leadership. When Distribution appears, it warns that the market is vulnerable to a downturn. As it moves toward -100, danger increases along with the probability of a bear market.