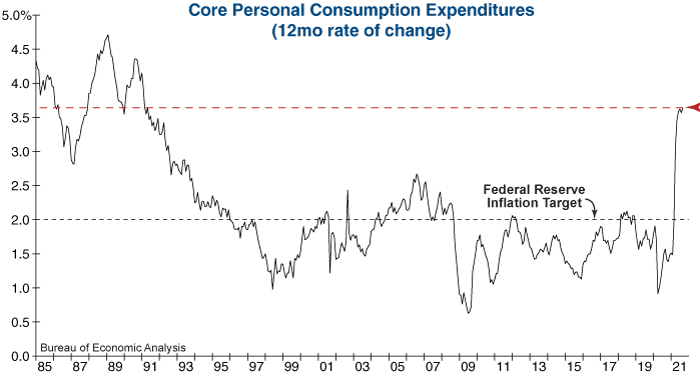

Core Personal Consumption Expenditures (PCE), the preferred inflation measure of the Federal Reserve, climbed to 3.64% last month to remain at the highest level in over 30 years. With the Federal Reserve recognizing that inflation has been hotter and more persistent than they expected, the central bank will likely start tapering its balance sheet in November. The bigger concern for Wall Street would be if the Fed is pressured into raising interest rates sooner than previously promised if pricing pressures do not subside in the months ahead. Bottomline, the Fed is set to slowly begin removing some of the gasoline that has helped fuel market gains over the past year, and the monetary road ahead is becoming more uncertain.