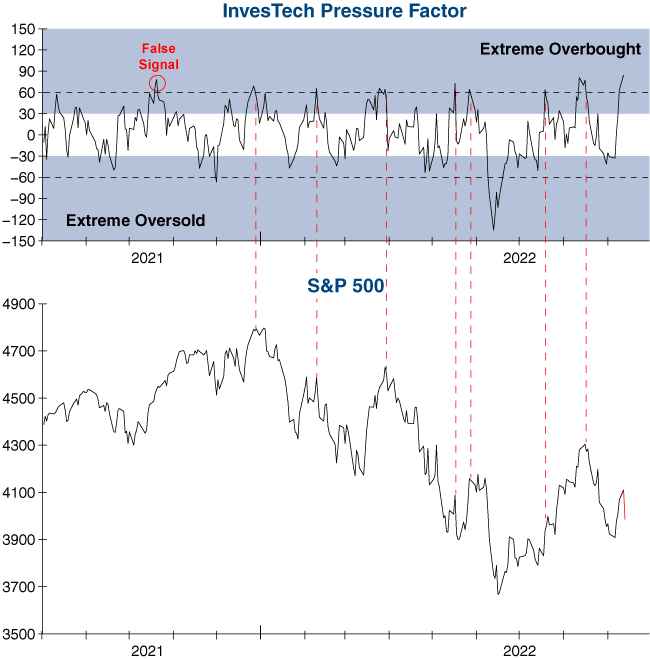

Our InvesTech Pressure Factor, which measures short-term overbought and oversold conditions, just reached the second highest reading of the past decade yesterday at +84. Pressure Factor readings in the extreme overbought zone (+60 or higher) have provided useful signals that the market is due for a near-term sell-off (red lines on graph below), and the S&P 500 is down by more than -3.1% today following yesterday’s extreme reading. While the hotter-than-expected Consumer Price Index (CPI) report was certainly the catalyst for today’s sharp sell-off, the disproportionate size of today’s decline is no doubt due to how extremely overbought the market was heading into the CPI print. Going forward, the Pressure Factor will continue to be a key tactical tool as we navigate this ongoing bear market.

Eli Petropoulos, CFA – Sr. Market Analyst