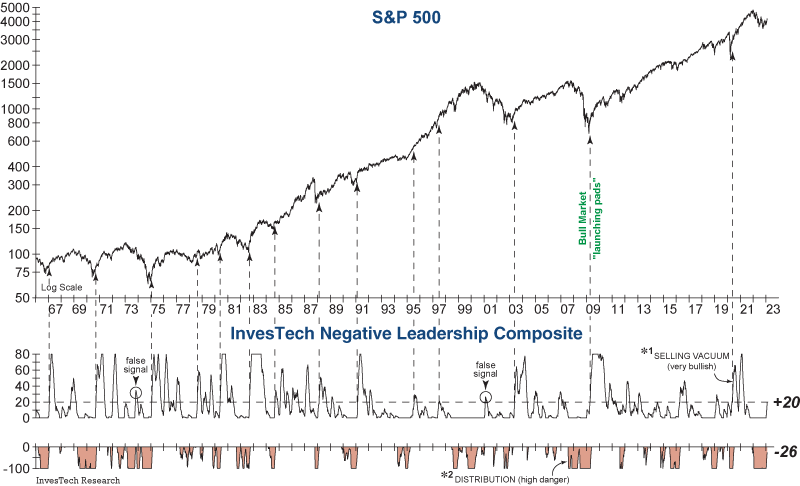

Technical indicators started 2023 strong, with a bullish Breadth Thrust signal emerging just two weeks into the new year. Since then, the absence of downside leadership has enabled the bullish Selling Vacuum component of our Negative Leadership Composite (NLC) to break through +20 for the first time since 2020.

The Selling Vacuum has proven to be a reliable technical tool, however, there have been a few false signals, such as during the 1973 and 2001 bear markets. So while today’s reading of +20 is a positive development, a reading of +40 or higher would inspire a much greater degree of confidence as these signals have frequently led to positive returns over the next six months.

While the technical data continues to improve, significant risks in the macroeconomic data still remain. In light of this dichotomy, our Model Fund Portfolio has increased its invested allocation to 53%, but still holds a sizeable 47% cash buffer. We will remain vigilant and objective as we watch for this conflicting data to be resolved.

Eli Petropoulos, CFA – Sr. Market Analyst