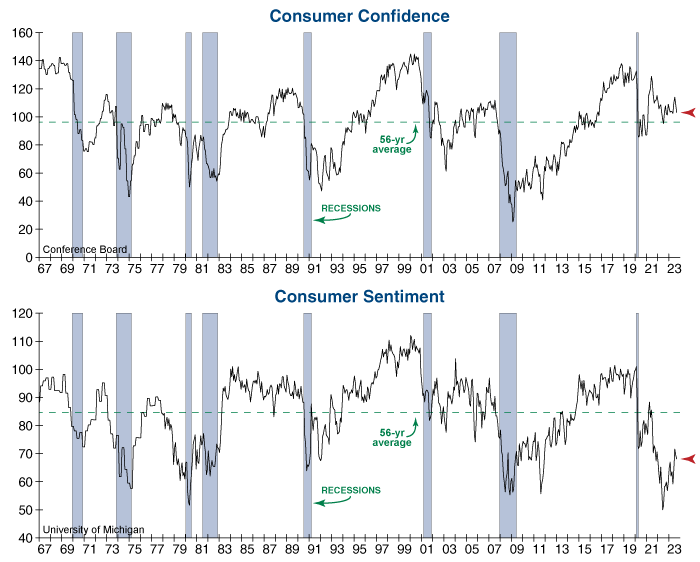

Strong consumer spending has been a key economic driver of the post-pandemic recovery, yet recent data indicates that consumers are becoming increasingly stressed. Consumer Confidence from the Conference Board missed expectations and declined for the second month in a row in September, as consumers’ outlook for the economy deteriorated. Likewise, Consumer Sentiment from the University of Michigan, which measures how consumers feel about their personal financial situation, fell this month, and remains at a historically depressed reading (see graphs below).

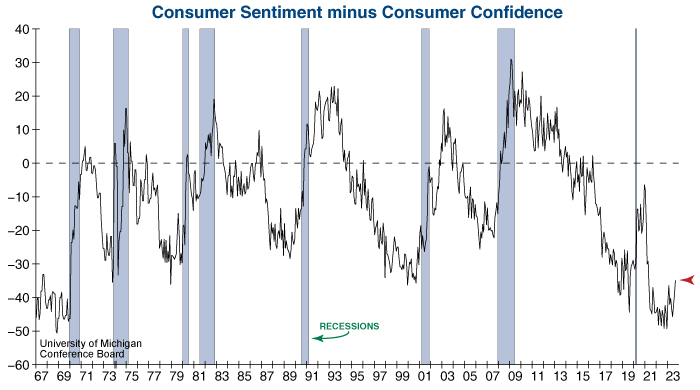

Additional insight can be gained by subtracting Consumer Confidence from Consumer Sentiment. Historically, this indicator has been a reliable recession warning flag, as Consumer Sentiment tends to fall first because it’s more focused on how consumers feel about their own finances, while Consumer Confidence follows suit as the consumer weakness permeates the economy at large.

When Consumer Sentiment minus Confidence drops to a reading of -25 or lower, it is an early indication of rising risk in the economy. However, when this indicator bottoms and turns higher from such depressed readings, it usually confirms that recession is imminent.

Currently, the difference between Sentiment and Confidence has reached the narrowest level since early 2021. If this indicator continues to trend higher in the months ahead (due to declining Confidence), it would likely confirm that the long-awaited recession is at hand.